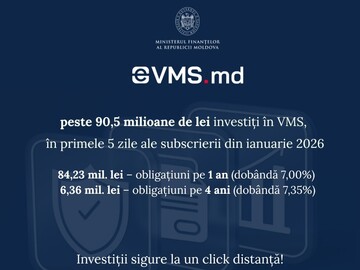

Over 90.5 million lei were invested by Moldovan individuals in government bonds through the eVMS.md platform in the first five days of the new subscription period in January

The Ministry of Finance reported this, noting that during the first five days of the subscription period, which ran from January 12 to 21, the total volume of investments in government securities made through the eVMS.md platform amounted to 90,597,200 lei. 705 transactions were concluded by 589 investors, confirming the public's continued interest in savings and investment instruments offered by the state. The majority of the financial resources raised over the five days were directed toward government bonds with a maturity of one year, in which 84,232,800 lei were invested through 563 transactions conducted by 509 investors. Meanwhile, government bonds with a maturity of four years attracted 6,364.4 million lei in 142 transactions conducted by 129 investors. The Ministry of Finance previously established a monthly frequency for government bond issuance, ensuring the population has constant access to reliable savings and investment instruments. The interest rate is fixed, and payments are made semi-annually, directly to investors' bank accounts. According to the calendar, the next sessions in the first quarter of 2026 are scheduled for February 9-18 and March 9-18, during which investors will be able to choose bonds with maturities of 1, 2, 3, or 4 years. Detailed information on the subscription terms is available on the official website of the Ministry of Finance and on the eVMS.md platform. It was previously reported that Moldovan individuals invested over 525.3 million lei in government bonds on the eVMS.md platform in 2025, including over 51.5 million lei during the last subscription of the year in December. In 2025, 10 bond placements with maturities ranging from 1 to 4 years were conducted through the eVMS.md platform. A total of 2,131 investors participated in these placements, and the total investment raised amounted to 525,332,800 lei.// 16.01.2026 — InfoMarket