Are we heading for hyperinflation? It all depends on the correct diagnosis and the prescribed treatment.

Commentary by InfoMarket Agency

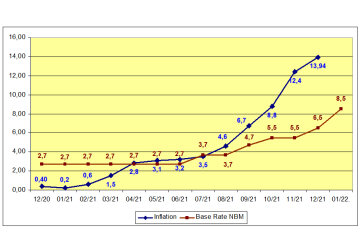

Two absolute records were broken by inflation in Moldova in 2021. In January, the lowest inflation rate in the country over the past 10 years was registered - 0.2% on an annualized basis, in December - the highest - 13.94% on an annualized basis. Moreover, if in the first eight months of the last year the inflation rate did not go beyond the corridor set by the monetary policy of the National Bank of Moldova (NBM) (5% ± 1.5 percentage points, that is, from 3.5 to 6.5% per annum), then over the last four months of the year, inflation has tripled! And, as the NBM forecasts, this growth will not be stopped until mid-2022.

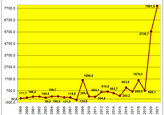

Dynamics of inflation in Moldova in 2015-2021

In an interview with the Moldovan media, NBM Governor Octavian Armasu said: The annual inflation rate and core inflation will grow rapidly in the first half of the year, after which growth will slow down. At the same time, it is not specified to what upper limit inflation will accelerate, from which upper branch it will have to be “taken down” and when the NBM will be able to achieve its “fundamental goal of ensuring price stability”.

It is obvious what the National Bank itself will never admit: the regulator is “shocked” by what is happening; therefore its actions can be either spontaneous and erroneous, or correct and timely. This is due to a combination of many factors, but above all - the energy crisis and the crisis of pent-up demand. But to be honest, all this was known, and it was quite possible to prepare for this in order to soften the blows.

Pent-up demand increased pressure on many industries, with prices beginning to rise everywhere before the energy crisis hit. And by the beginning of the heating season, due to various reasons and circumstances, the world received the highest gas prices and rising prices for all other types of energy carriers. In Moldova, the cost of gas increased 4 times: from $126.7 per 1,000 cubic meters in January 2021 to $460 in November with an intermediate anti-record of $800 in October 2021. Fuel prices increased 29.3% over the year. Food products are also growing in price; in agrarian Moldova, prices for vegetables increased by an average of 43.8% over the year.

Back in November 2020, the world-famous futurist Michio Kaku, who took part in the Moldova Business Week forum, predicted inflation in an interview with several Moldovan journalists, among whom the InfoMarket editor was present as well. He, in particular, said that at the height of the pandemic in 2020, in almost all countries, it was registered deflation associated with a forced slowdown in the economy. Michio Kaku drew attention to the fact that many countries launched printing presses, the rest actively borrowed money. “And that will have to be paid for in the near future,” Michio Kaku said almost a year and a half ago, which is exactly what happened in 2021. The futurist was right. But here is what it is important: predicting world inflation in 2021, Michio Kaku called on governments to take measures so that inflation does not turn into hyperinflation, since all the prerequisites already existed for this.

I would not like it to happen in Moldova, but... One of the criteria for hyperinflation is the halving of purchasing power for three years in a row. Inflation in Moldova in 2019 was 7.5% per annum; in 2020 - 0.4%; in 2021 - 13.9% per annum. Cumulatively, the purchasing power of the Moldovan leu (MDL) has decreased by 21.8% over the past three years. But what will happen this year if in December 2021 inflation added 1.66% in just one month? And if prices increase by 2% every month, this is already called hyperinflation.

Today, the prerequisites for stopping the growth of inflation are not yet visible: Deputy Prime Minister Andrei Spinu has already announced that gas in January this year for Moldova will cost $646 per 1,000 cubic meters that is, 60% more than in December 2021. The largest electricity supplier, Premier Energy, asked the National Energy Regulatory Agency (ANRE) for permission to double prices. Even if the government convinces the electricity supplier to postpone this issue for a month, one way or another, the deferred costs will be included into future consumer bills.

And what can the National Bank do in such a situation, while facing the main task of "achieving the fundamental goal of ensuring price stability." Its main instruments are monetary policy, by managing the mechanisms of which, of course, it is possible to mitigate the pressure of the external macroeconomic situation, which generates pronounced inflationary pressures against the backdrop of the energy crisis in the region. The NBM Governor Octavian Armasu emphasizes that “... the results at the country level, regardless of the phenomena and events that are taking place, depend not only on one institution, the joint efforts of all authorities are necessary, within the limits of their powers of activity.”

Indeed, not only the regulator, but also all state authorities need to perform thoughtful and well-coordinated work. The NBM itself is already operating within its spheres of influence. So, having set the base rate at 2.7% per annum back in November 2020, the NBM raised the rate four times over the last five months of the year (late July - December), not in hundredths or tenths, but in whole figures: the largest last year's growth - by 1.8 percentage points - was approved by the National Bank on October 5, 2021. And this year, the decisions of the NBM are breaking anti-records: for the first time since the fall of 2015, on January 13, 2022, the regulator raised the rate by two percentage points at once: from 6.5% to 8.5% per annum. To sterilize the money supply and reduce foreign exchange pressure, the rate of required reserves in foreign currency was increased - also by 2 percentage points - to 28% of the amount of funds raised. Thus, the National Bank will try to sharply reduce the demand for money in lending and sterilize the money supply, directing it from consumption to deposits. To all appearances, interest rates on loans and deposits will grow to a big extent in the near future.

The graph, which shows the inflation dynamics of the NBM base rate, indicates that since the second half of the year the regulator seems to be "barely keeping pace" with inflation.

Dynamics of inflation in Moldova and the base rate of the NBM in 2021

Dynamics of changes in the base rate of the NBM in 2019-2021 by the dates of its change

The picture is, unfortunately, not very enjoyable, but we have to live with this reality. Different countries go through the period of the global crisis in their own way, depending on the starting opportunities and the ability of the authorities and regulators to influence the situation in accordance with their powers. We see two possible scenarios of events: optimistic and pessimistic.

The situation in the world is extremely complex and there are still many uncertainties. Someone considered that the gas crisis would pass in two or three months, but alas! The current geopolitical conflict has come for a long time. We must understand that no one will make life easier for us, especially against the backdrop of increased demand for energy resources. We considered that gas at $800 per 1,000 cubic meters, paid by Moldova in October, is the marginal price. As a reminder, in November, gas cost $460, and in January the price was announced at $650 per thousand cubic meters. What will happen if the growth continues, and the price of $800 will seem like a boon to us? Such a scenario must also be foreseen. And against this background, the statements of government members that they will take loans from commercial banks to pay for gas supplies are, at a minimum, naivety and populism: which bank will undertake to lend for this?

The most important task today is to give a correct assessment of the situation. Further comments are not possible without this.

If the National Bank along with the authorities, in concert, manages to quickly make the right decisions, the annual inflation rate in Moldova will not go beyond 20%. If, however, a coordinated policy and a monetary policy cannot be achieved, we, unfortunately, may face hyperinflation probably even before the middle of the year.

Inflation in Moldova in 2004-2021

NBM Governor Octavian Armasu provides forecasts and estimates. He said that the regulator will come out with a new forecast in late January - early February. This assessment is extremely important for everyone who lives and works in Moldova.

When the “diagnosis” is announced, and the National Bank has all the necessary information to make a correct “diagnosis”, it will be clear how advanced the disease is and by what means it will need to be treated. And the announced methods of treatment will become a guideline for everyone in terms of what we should expect in 2022, at least in the very short term of the first half of the year. // 18/01/2022 - InfoMarket.