Deposit rates are at their peak. Market conjuncture or Why banks need individuals’ deposits

Commentary by InfoMarket Agency

Moldova became the first country to start easing monetary policy, forecasting a slowdown in inflation. With this statement the NBM Governor Octavian Armasu in early December commented on the decision of the NBM Executive Committee to reduce the base rate by 1.5 percentage points: from 21.5% to 20% per annum. We can assume that the peak is passed. Now the rates on loans and deposits will gradually go down. But for the time being, with rather high rates on individuals’ deposits, banks, as it were, offer: seize the moment!

The 2020 pandemic caused deflationary processes, primarily due to pent-up demand. In those conditions, the NBM lowered the base rate in order to stimulate the economy, and in November 2020 it reached its historic low: 2.65% per year, and remained at this level for almost 9 months. In 2021, inflationary processes were already evident, and the rate went up; slowly at first, and rapidly this year, the NBM first increased it by 2 percentage points, then by 3 percentage points. It peaked in August and November, at 21.5% per annum.

The main purpose of the rate hike is to slow inflation by slowing the economy. The higher the rate, the more expensive the loans, which means that the market refuses lending, and rates on deposits rise, free money is attracted in banks and also reduces the burden on inflation.

In addition to the rate, the National Bank is sterilizing the money supply by increasing the mandatory reserve ratio of funds attracted primarily in Moldovan lei (MDL). In August, the ratio reached 40%, which is how much banks have to reserve on the regulator's accounts from the amount of deposits attracted. Now, by the December decision of the NBM, the reserve requirements are reduced to 34%, which, according to Octavian Armasu, will release into the economy about 3.2 billion lei.

These are all monetary decisions of the National Bank to slow the growth of non-monetary inflation. The current inflation is due, above all, to the energy crisis, which has swamped all of Europe. But apart from the regulator, there are several other players in the banking and financial market: the Ministry of Finance (government bonds), commercial banks (loans/deposits) and, in fact, banks' clients (individuals and legal entities). And each in the established rules of the game acts in their own interests. The most "timid" and unpredictable player is the individuals, especially when it comes to deposits. Banks have a special attitude to this category of clients.

During the period of a sharp increase in the base rate of the NBM, the commercial banks were slowing down the similarly sharp increase in credit and deposit rates. Considering that on December 5 the NBM started loosening the regulatory measures, the trend of increasing the rates reversed 180 degrees.

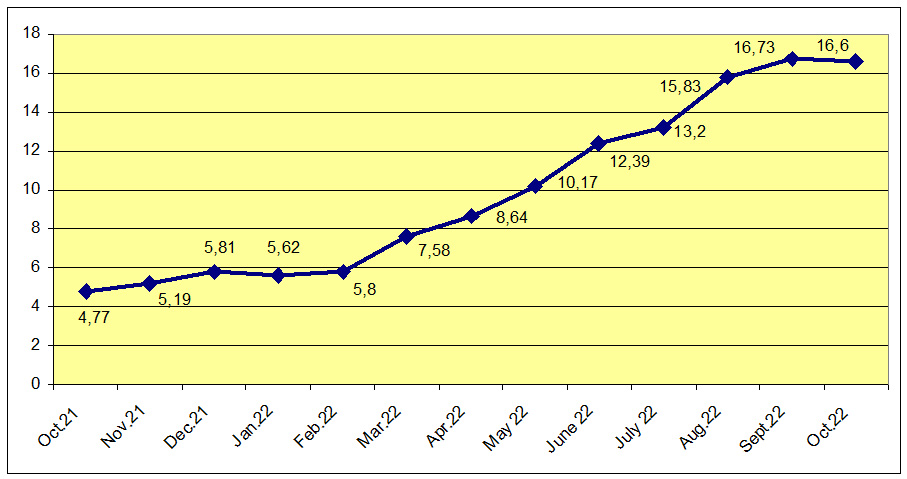

Throughout the year, banks were raising deposit rates very slowly. Some of the most profitable deposits for individuals were the term deposits for a period of 12-24 months. In January, the average rate on these deposits was 5.62% per annum (loans for 6-12 months - 6.04%), which was very close to the base rate of the NBM at the beginning of the year, and in October - 16.6%, with the NBM rate of 21.5%. Since mid-summer there has been a sharper rise in rates.

Over the past year, when the refinancing rate has risen particularly sharply, going from 6.5% (December 2021) to 21.5% (August 2022), and the annual inflation rate reached 34.62% by October 2022, not a single commercial bank offers a deposit rate that will cover the inflation rate. Even if we consider that according to the NBM forecast, at the end of 2022 it will be 28.8%, and in 2023 - 16% per annum.

Dynamics of rates on deposits for a term of 12-24 months (October 2021-October 2022), in %

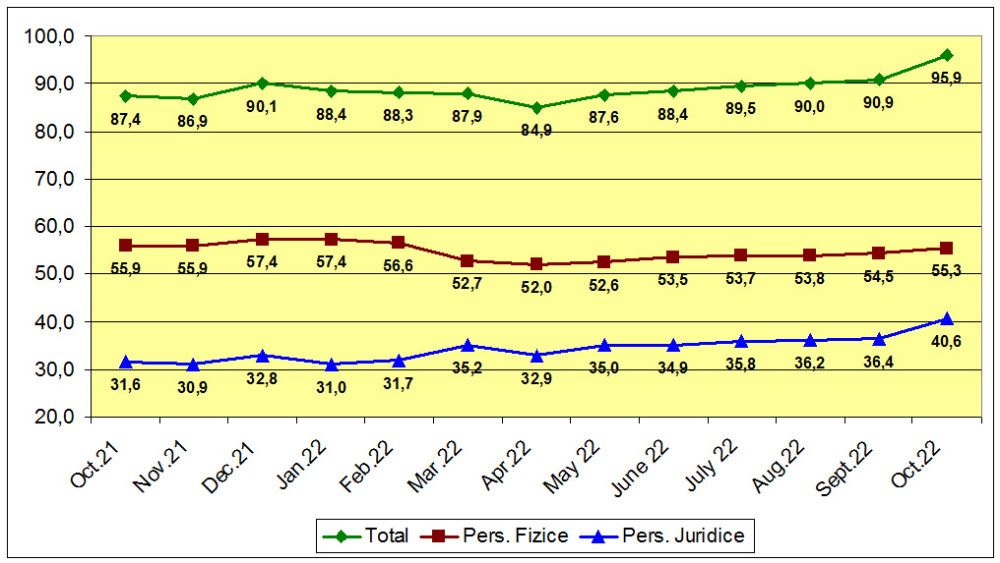

The total volume of deposits in the banking system is growing. During the year (October 2021 vs. October 2022) it increased by 8.51 billion lei or 9.7%, totaling 95.95 billion lei as of October 31, 2022. At the same time, the volume of individuals’ deposits decreased by 0.5 billion (by 1%), amounting to 55.33 billion lei. That is, the growth of deposits volume in bank accounts for the year occurred at the expense of legal entities.

The reason for the outflow of individuals’ deposits is the uncertainty associated with the war and the increase in current costs.

The reason for the inflow of legal entities’ deposits - delayed investments and development plans until stable times.

In general, the share of individuals’ deposits in the total amount of deposits attracted by banks reached 64.9% in January 2022 and decreased to 57.7% in October 2022.

Dynamics of the volume of deposits in October 2021-October 2022 (in billions lei)

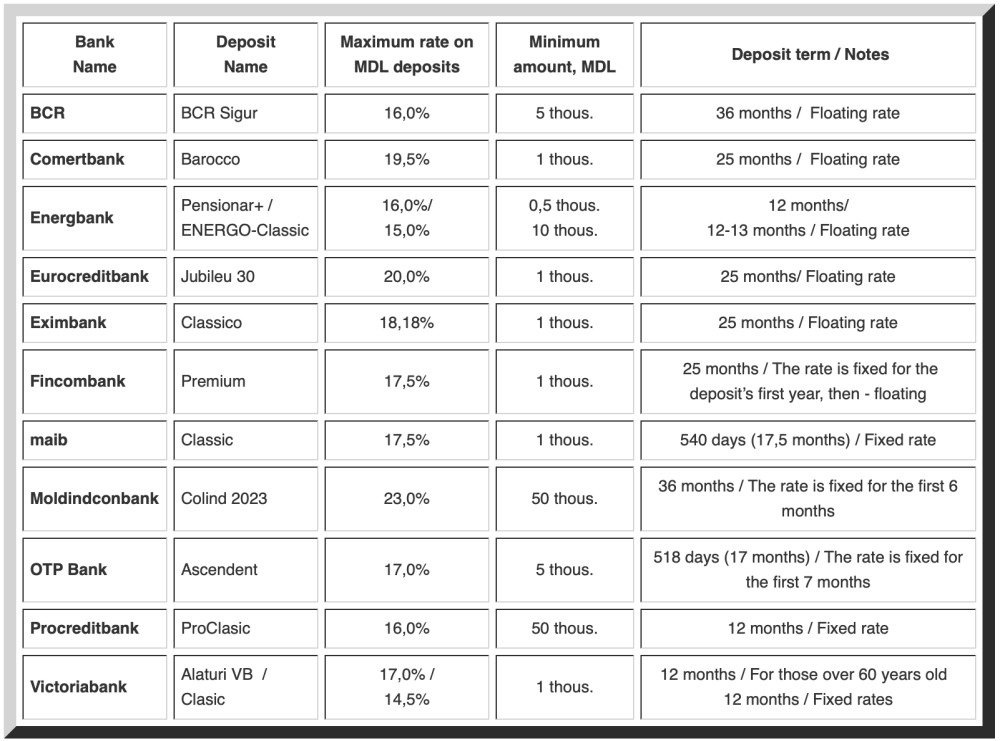

The table does not take into account promotions, drawings, etc., conducted by banks.

It would seem that it is easier, more interesting and more profitable for commercial banks to work with legal entities. Even the rates on deposits of legal entities are two to three times lower than the rates on deposits of individuals.

However, almost all advertising campaigns of Moldovan banks are aimed at attracting customers - individuals, for loans, bank cards, but, above all, for deposits.

Looking through the offers published on the official websites of commercial banks, we have compiled a table of the most profitable deposits for each financial institution, with notes on the situation at the beginning of December 2022.

The table does not take into account promotions, drawings, etc., conducted by banks.

Why do banks need individuals so much? After all, if you think about it, servicing them is more expensive than servicing legal entities, you have to pay higher rates on deposits than for legal entities, and it is more difficult to collect money by the crumbs than from a dozen legal entities. But the latter is the main point: individuals are a stable resource base for banks. Withdrawal of one client-an individual is not as painful as withdrawal of a large legal entity.

Banks have diverse relations with individuals as well, even attracting, as it seems, expensive resources at high deposit rates, banks can redistribute resources without losing profitability. At the same time, they create more points of contact with individuals (loans, deposits, bank cards, servicing accounts, etc.) The more such points, the stronger and more stable these relations and the lower the risks for both sides.

High rates on deposits do not mean lack of liquidity. By the way, all banks have it above the required minimums. Liquidity coverage ratio (LCR) varies from 118.8% to 395.5% with the system average of 271.7%.

This year, the growth of rates allowed customers (individuals) to feel a tangible increase in income on deposits, banks began to pay more and compared with the income at the rates of recent years, the difference is noticeable.

When a bank sees an opportunity to earn for itself and for its customers, to strengthen its stable base and increase the loyalty of depositors, it does it. And to encourage those who are willing to place a deposit for a long period, say for 3 years, the bank offers a high rate - sort of like a bonus to the customer for agreeing long-term cooperation. But there are not many of these, and the risks are spread over time. In Moldova, as mentioned above, the most popular terms for deposits are 12-24 months. And this also benefits the bank: the interest rate is adjusted faster in accordance with the market situation - repricing. Repricing is profitable in a falling market and not profitable in a growing one.

Apparently, the market for deposit and loan rates is now declining, as evidenced by the situation in the government securities market, where rates have also gone down. At the first auction after the decision to reduce the base rate from 21.5% to 20, which was held on December 13, the rates on securities with the circulation term of 91 days decreased from 19.38 to 18.33% per annum; with the circulation term of 182 days - from 21.86 to 20.17% per annum; with the circulation term of 364 days - from 21.85 to 19.93% per annum.

That is why now we observe, perhaps, the highest rates on deposits offered by Moldovan banks. Yes, they are floating or fixed only for a few months and later they will be adjusted. But they will not be higher. At least in the short term. Unless some new turmoil happens.

By luring depositors with such rates, bankers thought that a lot of money still lies "in mattresses". A lot of money has gone there this spring, most likely through conversion into foreign currency. Buying EUR/USD in spring at a sufficiently high exchange rate, the average citizen does not want to sell it at the end of the year at a lower rate - the losses from the exchange rate difference are too obvious. The "Mattress" is more reliable, he believes.

The general atmosphere was slightly spoiled by the legislative fuss around the taxation of income from deposits, when instead of 3% this year it was proposed to raise the rate to 12% from next year. We managed to convince the authorities to raise the rate not so much - up to 7%.

Individuals for banks - it is a very sensitive client in his decisions, he can "vote" with his feet - away from banks, where the state, as many believe, is now getting into this pocket of them as well.

Bankers are not thrilled either. As mentioned above, for them the army of individuals is a stable resource base. They believe that it is necessary to stimulate the attraction of funds to the economy through banking instruments. Everyone will benefit from this: the clients, the banks and the economy.

Individuals have shown their resilience during the crisis, the resilience that the banking system in particular and the entire economy of the country as a whole need. Jerky movements, like a sharp increase in tax on dividend income, do not lead to anything good and undermine confidence in the system and the state, say the banking community. Well, in the meantime, banks are doing everything possible to maintain this confidence, while strengthening their resource base. //19.12.2022 - InfoMarket.