The Ministry of Finance and investors in the State Securities market at the peak of placement volumes

Commentary by InfoMarket Agency

The Ministry of Finance is reducing the previously planned issue of State Securities (SS) worth 4.9 billion lei. Amendments to the 2022 State Budget Law, adopted by the Government on Monday, April 18, which no doubt will be adopted by the Parliament, provide that from the sale of SS on the primary market in the current year the Ministry of Finance will direct to finance the budget deficit - zero lei! The previous version of the law envisaged that 4.9 billion lei from the SS market would be directed to finance the deficit.

Does this mean the closure of the SS market in the country, in operation since 1996? Definitely not! Although some political economists have already stated that the Ministry of Finance is killing the market of State Securities and stops their issue. That’s what the politicians are for. Nevertheless, the situation in this segment has not been simple for several years, and after the pandemic, the onset of the energy crisis and military action in the neighboring country, it has come close to critical.

In fact, this year the Ministry of Finance decided to stop the growth of securities in circulation, but not on its own - the market "helped" it. Looking at the market indicators, we can trace how this decision was justified.

Investors (first of all, commercial banks), which buy SS, helped the Moldovan budget a lot in difficult times. When external financing, loans and grants are suspended for one reason or another, or are delayed, the Ministry of Finance can always count on domestic investors. Yes, it is necessary to pay for borrowed funds (to service SS), but their profitability remains in Moldova, and is not taken abroad as it happens in the case of external lending. Some will argue that domestic rates are higher than the cost of foreign loans, but statistics say that government rates can be below 5% per year in a relatively stable period, while foreign loans are subject to foreign exchange risks. This will be especially evident this year, as expected.

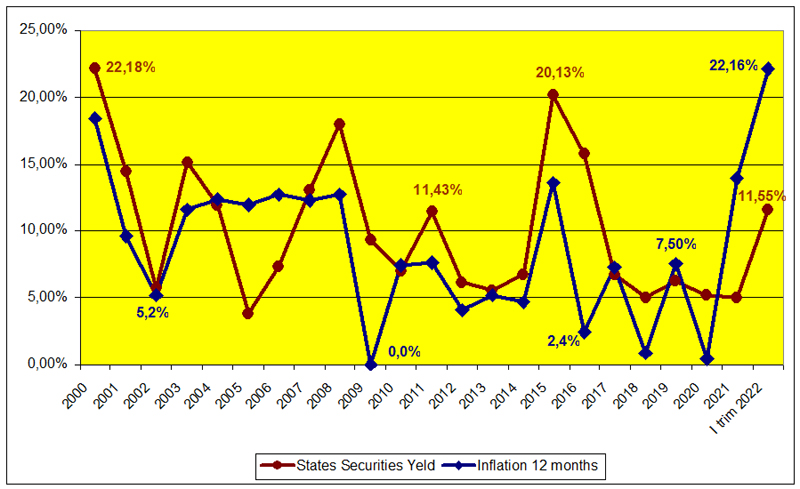

State Securities Yield and Inflation by Year

Despite the fact that many believe that the SS market is a "pyramid" (the volume of securities in circulation increases from year to year, and it is more difficult for the Ministry of Finance to service them), the economy has developed one way or another. The situation was critical in 2009 (parliamentary elections and change of political course), but even more critical in 2000 and 2021. This is what the last 20 years look like…

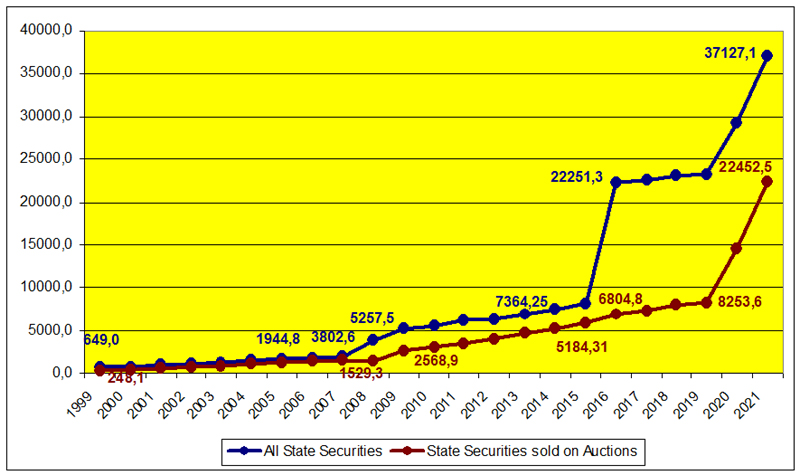

Dynamics of State Securities in circulation (million lei)

The blue line is all SS (including those issued under special programs and converted state debts), and the red line is SS placed during auctions (market).

The sharp increase in 2016 is the issue of special-purpose SS worth 15.45 billion lei to cover the debt of the state, formed due to the "theft of the billion".

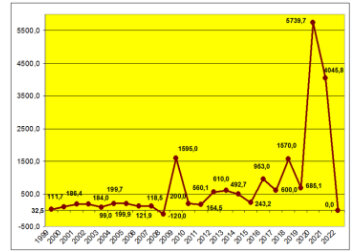

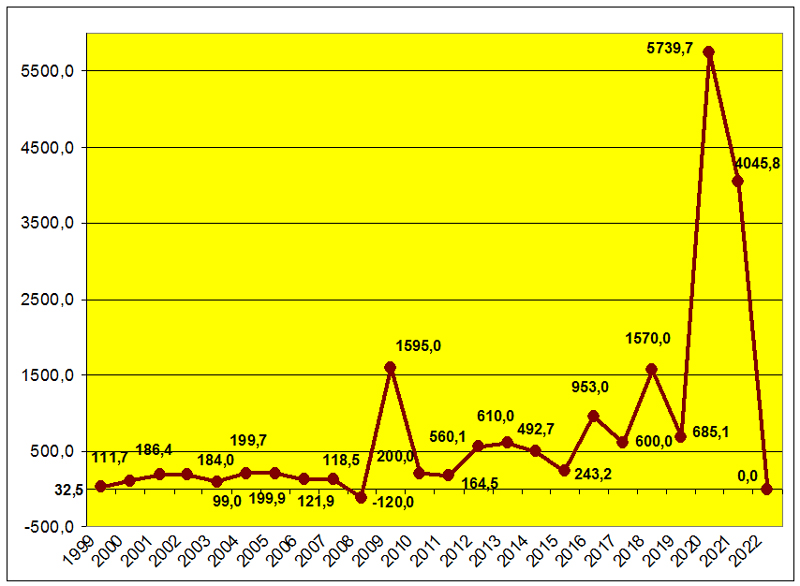

And here is how the annual financing of the budget deficit through the primary sale of SS at auctions looks like - the volume of SS in circulation increases by these amounts from year to year.

Dynamics of Financing the Budget Needs from the Primary Issue of SS (million lei)

Last year, the law stipulated that 5 billion lei could be placed additionally; there was even a draft law that provided for an increase to 7.89 billion lei. But already in the summer months, the Ministry of Finance stopped "getting" the necessary amounts and was forced to spend more on repayment than on collecting money for the budget needs. In the end, the law was not amended (leaving 5 billion), and de facto it was collected a little more than 4 billion lei.

The first quarter of 2022 showed that it is unlikely to collect the budgeted 4.9 billion lei this year. As of December 31, 2021, the volume of SS in circulation was 33.28 billion lei, and in three months (March 31, 2022) - 32.2 billion lei. That is, by issuing SS, the Ministry of Finance did not cover the needs of the budget deficit, but was forced (as in some months of the previous year) to pay for the previously issued SS from budget funds. In the 1st quarter this amount was 1.09 billion lei. In such conditions it is impossible to say that in the remaining 9 months it will return this sum to the budget and add the planned 4.9 billion lei. Therefore, the Finance Ministry decided to "break even" but in fact to "walk away at a loss".

Why is it not possible to place the planned volumes of SS? The initial reasons are, in general, clear. And they are clear, first and foremost, to investors. For many years, the Ministry of Finance has been trying to increase the maturity of State Securities (Government Bonds), and even managed to issue the first ever Government Bonds with a maturity of 7 years in 2021. But SS with a maturity of more than one year (2 years, 3 years, 5 years, 7 years) are not in great demand among investors. And in the current environment, investors (read: commercial banks) are going for Short-Term Securities.

Reference: Short-Term Securities are State Treasury Bills (T-Bills), with maturities of 91, 182, 273 or 364 days. Repayment with yield is at the end of the circulation term. Government Bonds (GB) have maturities of 2, 3, 5 or 7 years. Repayment is done in coupons every six months, the yield is also determined every six months in advance. Auctions are held every two weeks, on Tuesdays – State Treasury Bills, on Wednesdays – Government Bonds. T-Bills and GB together are called SS – state securities.

For example, at the April 13 auction, the Ministry of Finance put up for sale 2-year GB for a total of 20 million lei, the demand was only 6 million, the rate - 16% per annum.

And after the announcements of budget changes, the market changed immediately. At the April 20 auction, the Ministry of Finance placed 2, 3, 5 and 7-year GB worth 10 million each. The demand was 1.08 million; 0.9 million; 3 million and 2 million lei, respectively. Auction results: the Ministry of Finance fully satisfied the bids for 2-year and 3-year GB at 13.95% and 13.42% per annum, respectively. The 5 and 7-year GB were not sold at all (the Ministry of Finance offered for them a yield of 11% and 10% per annum respectively).

The situation is somewhat different with the T-Bills. The April 19 auction showed a huge demand for short-term securities. T-Bills-91 days: 80 million lei placed, demand - 373 million lei (15.93% per annum); T-Bills-182 days: 600 million lei placed, demand - 779.6 million lei (16.28% per annum); T-Bills-364 days: 700 million lei placed, demand - 493.8 million lei (17.61% per annum).

From the investor's point of view, why would they invest for 2 years at 13-16%, in conditions of full uncertainty, if they could obtain the same yield for 3 or 6 months?

Interestingly, while placing T-Bills-91 days worth 80 million lei, the Finance Ministry sold them for a total of 123 million lei, and in the case of T-Bills-182 days worth 600 million (with increased demand) sold them for a only of 206 million lei.

This means that investors are trying to raise the price of securities. The specifics of auctions are such that after the announcement of the declared amounts, the investor offers to buy a certain amount at the price he/she offers. And the Ministry of Finance already decides whether it wants to sell securities at the proposed price or not.

In 2016-2021, with a SS yield of 5-6%, inflation in the country was lower, and this made it profitable to invest in SS. In recent months, the situation has changed dramatically, but the Ministry of Finance is in no hurry to raise the yield on securities to the level of inflation. This, by the way, is one of the reasons behind the decision to amend the law on the 2022 budget. The fact is that the burden on the budget due to the previously issued securities (in circulation) is very high. And to continue to further increase volumes, especially at a high rate (today it is 16% per annum on average) is a luxury the Ministry of Finance cannot afford.

But it is also impossible to talk about closing the SS market. Currently, 32 billion lei are in circulation, of which about 20 billion are marketable securities sold at auction, the rest - securities of special purposes, about which we have already mentioned. The Ministry of Finance needs money to service 20 billion. Where can it get the money?

There are three sources for this: budget revenues, foreign loans, or domestic loans (i.e. to continue issuing Government Bonds). Everyone knows the condition of the state budget today: the energy crisis, social payments, refugee assistance, and this against the background of the decline in economic activity: at least 30% of the economy was tied up in export-import transactions with Russia and Ukraine.

External loans should be used both to pay off the deficit and to develop infrastructure projects, so that "tomorrow" they begin to repay the loans on their own. Under the new amendments to the state budget, its deficit has already exceeded the IMF's recommended norm of 3.5% twice - the deficit in 2022 is planned at 6.9%.

Thus, “the rescue of a drowning man depends on the drowning man himself.” Only on May 5, 2022, the Ministry of Finance should repay the amount of 1.4 billion lei on previously issued securities, and on May 19 - 1.45 billion lei. And it can take the money only from the SS market itself by issuing new securities; but only to the extent necessary to repay current amounts, because the rates today are three times higher than last year, and it makes no sense to stockpile money at these rates.

What should investors do? Despite the fact that the State Securities yield currently does not cover inflation, demand for securities, especially short-term ones, is very high. And it will be even higher, given the amendments in the budget law. Probably, on the background of such demand the rate on securities, if not decrease, then at least will remain at the current level. It is just that Moldova has not created investment instruments in 30 years. There are only three of them: State Securities market, deposits (not for banks) and real estate. So, part of the liquidity will be directed to the real estate market, which will cause prices to rise again. And it will be pushed up by the deficit.

Today the secondary housing in terms of prices has already caught up with the primary real estate, and the situation on the market is such that the ads for sale changed into ads for rent. Developers complain about a double increase in prices for building materials. Against this background (shortage of housing and lack of alternatives for investment), real estate prices could go up a lot. Although banks and insurance companies have restrictions in terms of investing in real estate, this segment is likely to feel some pressure from the contraction of the SS market.

We can also note the situation on the currency market and the struggle of the National Bank against inflation.... But should it be mentioned now? // 21.04.2022 - InfoMarket.