Inflationary measures amid high inflation, or anticipation of the National Bank of Moldova's Stop-and-Go policy

Commentary by InfoMarket agency

The National Bank of Moldova (NBM) takes inflationary measures when inflation is high. The law stipulates that the regulator's main task is to keep inflation within a specified range. For many decades, this range has been within the limits set for countries with developing economies: 5% per annum ±1.5 percentage points, i.e., between 3.5% and 6.5% per annum.

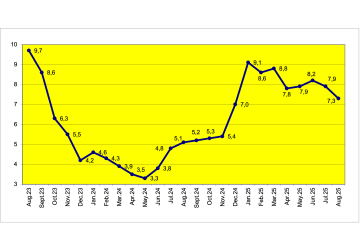

One of the most important tools of the NBM is the base rate: by adjusting its value, it is possible to stimulate the economy, investment, and consumption, as well as to slow down these processes. By lowering the base rate, the regulator sends a signal to the economy that loans should become more accessible, and investment and consumption should increase as a result. However, increased investment and consumption have an impact on inflation.

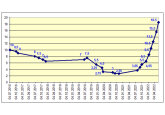

In December 2024, the inflation rate in Moldova rose sharply, exceeding the target range and reaching 7% per annum. This is despite the fact that for 14 months (excluding May 2025, when it stood at 3.3%), inflation in the country remained within the established range of 3.5% to 6.5% per annum. Yes, the main reason for the sharp rise in inflation was once again the energy crisis – and this is a case where, in the middle of winter, consumers are willing to pay any price for electricity and heating.

In response, the NBM sharply raised the base rate from 3.6% per annum (in effect since May 2024) to 5.6% per annum. The decision was adopted on January 10, 2025 (the National Bureau of Statistics of Moldova publishes the latest inflation figures on the 10th of each month). It is logical that in order to slow down inflation, the NBM is cooling demand for money, which is beginning to circulate more slowly, contributing to a decline in investment, consumption, and inflation.

As of late January, annual inflation jumped to 9.1% per annum, and on February 5, the NBM raised the base rate to 6.5%. From February to August 2025, inflation fluctuated up and down (long-term statistics show that such sharp fluctuations are very unusual for the Moldovan economy). In July, the rate stood at 7.9% per annum, and in early August, the NBM eased its monetary policy, lowering the rate from 6.5% to 6.25%. Despite the easing, August saw inflation fall to 7.3% per annum. The National Bank continued its policy and on September 18, 2025, lowered the base rate to 6% per annum.

Inflation dynamics August 2023 - August 2025, in percentage per annum

Dynamics of the NBM base rate August 2023 - August 2025 (% per annum)

Looking at these events and indicators, one question remains: if inflation has not yet returned to the target range (i.e., 3.5-6.5%), why is the regulator stimulating the economy by lowering the base rate? This decision will certainly not help bring inflation down to the target range. After all, the main task of the NBM, as laid down in law, is to keep inflation within the target range.

Was it too early for the NBM to start lowering the base rate when inflation only really began to fall in July and August? How indicative are the last two months, considering that summer and early autumn are traditionally a period of low inflation in Moldova: in relatively “stable” years, deflation was often recorded during these months.

The start of the heating season, on the contrary, has almost always been accompanied by rising inflation, which has been particularly evident in recent years against the backdrop of energy crises, the consequences of which have been an increase in energy prices. Incidentally, it was precisely the unpredictability and rise in energy prices that caused inflation to rise in December 2024, from 5.4% in November to 7% in December and 9.1% in January 2025.

Of course, the NBM has a number of other tools at its disposal to fulfill its main role of stabilizing inflation in the country. Perhaps, by lowering the base rate, it is counterbalancing with other, less obvious tools. But is this really the case?

Here is another indicator that affects the level of inflation in the country — the monetary base (M0 indicator). It reflects the foundation of the country's monetary system, including cash in circulation and commercial bank reserves at the NBM. In fact, it is the primary source of the entire money supply, from which broader aggregates such as M1 and M2 are formed.

In just two years (August 2023 - August 2025), Moldova's monetary base grew by a third!

Money supply dynamics in circulation - M0 indicator: August 2023 - August 2025 (billion lei)

When M0 grows, it means that there is more liquidity in the country, which means more investment and consumption. And this affects inflation growth in the medium term.

In developed countries, the monetary base grows by 5–10% over two years, which corresponds to moderate economic growth and inflation. For Moldova, where the economy grows by an average of 2–4% per year and the National Bank targets inflation in the range of 5% (plus or minus 1.5 percentage points), a 33% increase in the monetary base over 25 months is an alarming signal. It indicates that the amount of money in the system is growing much faster than the real sector of the economy is able to produce goods and services.

One of the reasons for this phenomenon is the increase in social spending by the state: salaries in the public sector, compensation, and other payments, especially in the run-up to elections. This increases the amount of money in circulation. Foreign grants, loans, and inflows from individuals abroad also put pressure on the growth of the money supply (currency entering the country is necessarily exchanged for lei).

However, inflows from individuals are unlikely to have a significant impact on the growth of the money supply, as this indicator has remained roughly the same over the past few years. In 2024, it amounted to $1.61 billion, down 1%; and in the first eight months of 2025, it amounted to $1.06 billion, down 2.4% compared to the same period last year. In other words, this factor should not have a significant impact on the growth of the money supply, as it is stable.

What definitely had an impact was external government borrowing. In 2024, Moldova received $1.004 billion (equivalent to 18.12 billion lei), which is $55.4 million (5.8%) more than in 2023. In the first half of 2025, it received $435.2 million (equivalent to 7.53 billion lei), which is $342.6 million (4.7 times) more than in the same period of 2024 ($92.6 million).(The main external government loans last year were in the second half of the year).

Over the past two years, there has been an increase in the volume of new loans issued. In August 2023, it was 3.23 billion lei; in August 2024, it was 4.28 billion lei; in August 2025, it was 4.75 billion lei. December 2024 saw a record high in new loans issued during this period, amounting to 6.12 billion lei. In other words, there is more money in circulation in the country due to the growth in lending, and the NBM is stimulating this by lowering the base rate.

Part of the money supply is absorbed by deposits, but their volume did not increase significantly during this period: August 2023 – 2.22 billion lei, August 2024 – 2.06 billion lei, August 2025 – 3.09 billion lei. The record for new lending during this period was set in December 2024, at 6.12 billion lei. As with lending, the record for attracting new deposits during this period was set in December 2024, at 3.87 billion lei.

Growth in the money supply always puts pressure on inflation, especially if the economy is unable to produce more goods and services. When there is more money in the system, consumer demand grows, while the supply of goods and services lags behind, resulting in price increases. This is particularly evident in Moldova's real estate market, where prices doubled in 2020-2024 and rose by another 40-50% in 2025.

To avoid falling into an inflationary spiral (a chain reaction of rising prices and wages, which further accelerates inflation), the National Bank must take measures to sterilize the money supply, rather than stimulate lending by lowering the base rate.

In Moldova's context, this is particularly dangerous given the high level of import dependence: as domestic demand grows, so do imports, which will put pressure on the Moldovan leu (MDL) exchange rate. If the MDL does not strengthen due to currency inflows, goods from abroad become more expensive, which further accelerates inflation.

In recent years, the country has already experienced severe price increases. In August 2022, inflation peaked at 34.29% per annum due to the energy crisis and rising global import prices. In 2023–2024, the National Bank managed to reduce inflation to 5–7% thanks to a tight policy and high interest rates. But now, against the backdrop of falling rates and increased fiscal spending (on civil servant salaries, pensions, and compensation), the money supply is growing rapidly again. With this trend, inflation could accelerate again to 8–10% per annum by the end of 2025.

In the current situation, the National Bank should take measures to reduce excess liquidity and not stimulate lending by lowering the base rate. The NBM, of course, understands this and intends to do everything possible to ensure that its forecast of inflation falling within the target range (5% ±1.5 p.p.) in December 2025 comes true. This means that in the remaining three months of the year, the National Bank will take additional measures and apply the tools available to the regulator.

But here, too, there is danger of volatility in the monetary policy of the National Bank of Moldova, a stop-and-go policy. This is when the regulator alternates between tightening and easing policy. For businesses and investors, this is not the most attractive prospect: uncertainty complicates long-term planning and, as a result, economic development; albeit in Moldova's case, it would be more accurate to say its recovery. //30.09.2025 – InfoMarket.