Monetary measures against non-monetary inflation

Commentary by InfoMarket Agency

In the 1H 2022, the National Bank of Moldova (NBM) sold $412.13 million in currency in the interbank market (in equivalent). Withal, the peak of sales was in January-April, when this amount reached $456.23 million. As can be already guessed, the main volume of sales was in March 2022, which was associated with a large influx of refugees from Ukraine, who exchanged hryvnias (UAH) through leis (MDL) into euros (EUR) for further movement to European Union countries.

Dynamics of currency interventions by the NBM in 1H 2022 (thousand USD)

| Purchase | Sale | Balance | |

| Jan | 6000 | 117376 | -111376 |

| Feb | 31000 | 142000 | -111000 |

| Mar | 14200 | 228000 | -213800 |

| Apr | 15950 | 36000 | -20050 |

| May | 36600 | 19000 | 17600 |

| June | 26500 | 0 | 26500 |

| 130250 | 542376 | -412126 |

We do not take into account SWAP transactions, which were also registered in the first half of the year, because, on the one hand, they were extremely insignificant in volume, on the other - the very form of SWAP transaction involves a reverse sale/purchase of currency. In fact - it is an exchange of currency at the cash gap with the obligation to make a reverse exchange at the rate agreed by the parties.

The NBM sells currency in the domestic market in order to meet the increased demand within the framework of its monetary policy, using the currency reserves for this purpose. As expected, over six months the reserves have decreased by $281.98 million, or 7.25%: from $3889.31 million in early January to $3607.33 million in late June. The difference of $100 million (between what the NBM sold in the market and how much its reserves declined) came both from the outstanding SWAP transactions and from the revaluation of the currency reserves themselves, which are placed not only in the US currency, but also in the currency of Europe, UK, assets in securities and even slightly in gold.

In general, the foreign exchange reserves of the National Bank are all right - their volume covers more than five months of imports of goods and services to Moldova, although, according to the adopted requirements for the stability of the national currency, it must cover four months of imports. Moreover, in the last two months - May and June, the NBM started buying more hard currency than selling it, and in June it did not sell anything.

The sale of foreign currency by the National Bank is one of the ways to sterilize the money supply. That is, $412.13 million sold by the National Bank in six months means that the money supply in circulation has decreased by this amount, that is, by about 7.5 billion lei.

In conditions of high inflation, the growth of which, unfortunately, has not yet reached its peak, this is a quite reasonable policy. Along with increasing the base rate and the required reserves norms, the measures taken by the National Bank are aimed at slowing down non-monetary inflation in a monetary way.

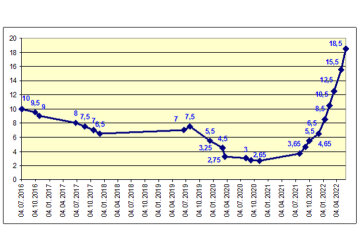

Let us remind that, since January 2022, the NBM has already raised the base rate five times, almost monthly.

Dynamics of the NBM base rate (by date of change) in 2016-2022

Much has already been written about it: the growth of the base rate entails an increase in deposit and lending rates, which on the one hand hinders lending, on the other hand makes deposits more attractive. Thus, consumption is reduced, which should have an effect on reducing the inflation rate. But this is also a monetary measure, which the central bank applies within its competence.

In order to sterilize the money supply, the NBM also raises the obligatory reserve requirements for commercial banks. For funds attracted in MDL these rates were increased three times this year - from 26% in January, to 28% in February, to 30% in May and to 32% in June. However, according to the data of the National Bank, in January, the total amount of the required reserves for all banks amounted to 12.51 billion lei, while in June it made 15.05 billion lei. The total volume of funds attracted by banks slightly decreased (by 2% compared to January), though.

| Observation period | Maintenance period | Amount of attracted funds subject to reservation in MDL and non-convertible currencies (millions of MDL) | Required reserves ratio for attracted funds in MDL and non-convertible currencies (%) | Required reserves maintained on accounts with NBM (millions of MDL) | Interest rate applied to payment for obligatory reserves (%) |

| 16.01.2021-15.02.2021 | 16.02.2021- 15.03.2021 | 44 319,4 | 32,0 | 14 182,2 | 0,15 |

| 16.02.2021-15.03.2021 | 16.03.2021- 15.04.2021 | 44 716,0 | 30,0 | 13 414,8 | 0,15 |

| 16.03.2021-15.04.2021 | 16.04.2021- 15.05.2021 | 44 602,6 | 28,0 | 12 488,7 | 0,15 |

| 16.04.2021-15.05.2021 | 16.05.2021- 15.06.2021 | 45 150,6 | 26,0 | 11 739,2 | 0,15 |

| 16.05.2021-15.06.2021 | 16.06.2021- 15.07.2021 | 46 377,3 | 26,0 | 12 058,1 | 0,15 |

| 16.06.2021-15.07.2021 | 16.07.2021- 15.08.2021 | 46 822,2 | 26,0 | 12 173,8 | 0,21 |

| 16.07.2021-15.08.2021 | 16.08.2021- 15.09.2021 | 47 454,5 | 26,0 | 12 338,2 | 1,15 |

| 16.08.2021-15.09.2021 | 16.09.2021- 15.10.2021 | 47 613,5 | 26,0 | 12 379,5 | 1,98 |

| 16.09.2021-15.10.2021 | 16.10.2021- 15.11.2021 | 47 935,1 | 26,0 | 12 463,1 | 3,33 |

| 16.10.2021-15.11.2021 | 16.11.2021- 15.12.2021 | 48 604,6 | 26,0 | 12 637,2 | 3,50 |

| 16.11.2021-15.12.2021 | 16.12.2021- 15.01.2022 | 48 132,9 | 26,0 | 12 514,6 | 4,44 |

| 16.12.2021-15.01.2022 | 16.01.2022- 15.02.2022 | 49 787,3 | 26,0 | 12 944,7 | 5,73 |

| 16.01.2022-15.02.2022 | 16.02.2022- 15.03.2022 | 49 417,2 | 28,0 | 13 836,8 | 7,50 |

| 16.02.2022-15.03.2022 | 16.03.2022- 15.04.2022 | 47 739,5 | 28,0 | 13 367,1 | 9,53 |

| 16.03.2022-15.04.2022 | 16.04.2022- 15.05.2022 | 45 582,4 | 28,0 | 12 763,1 | 10,50 |

| 16.04.2022-15.05.2022 | 16.05.2022- 15.06.2022 | 46 092,9 | 30,0 | 13 827,9 | 13,11 |

| 16.05.2022-15.06.2022 | 16.06.2022- 15.07.2022 | 47 038,8 | 32,0 | 15 052,4 | 16,30 |

It is interesting that the NBM, setting the norms of mandatory reserves, pays commercial banks to "freeze" these funds. However, the rates are not very high and are fully linked to the base rate set by the NBM. As we see, in early 2021 the rates were also quite high - 32% - and the rate paid by NBM to commercial banks was 0.15% per annum. The base rate then was 2.65% per annum. Today's rate at the base rate of 18.5% - is 16.30% per annum.

In general, banks, with good corporate governance, never lose their funds (funds of shareholders). The base rate grows - they raise rates, and when it goes down - they lower it. So even today, in a very unclear and poorly predictable situation, they receive 16.30% per annum on "frozen" funds in the NBM, without risking anything. Maybe that's what dictates the fact that, despite the inflation of almost 32%, the rates on deposits, offered by the commercial banks, barely come close to 13% per annum?

Or maybe it is also because the rates on the government securities market are rising. The most popular government securities (GS) with a maturity of 91 days are sold today at 15.71% per annum, while GS-365 days - 19.89% per annum. In January, the rates on securities did not reach 10% per annum. By the way, thanks to the growth of rates on government securities, some banks greatly increased their profits in the 1H 2022. We recently wrote about this in detail.

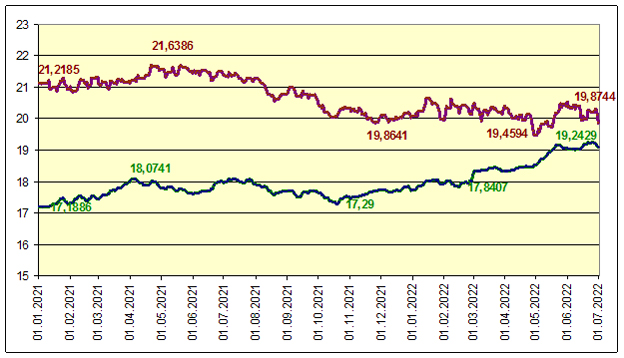

And finally, what does the NBM do with the official exchange rate of the MDL as an instrument of monetary control of the inflation rate. We always emphasize that the MDL exchange rate is always quoted only against the USD. The exchange rate of all other currencies is calculated according to the cross-rate. However, in this graph we wanted to visualize how the USD/EUR exchange rate changed on the world markets.

Dynamics of the MDL/USD exchange rate in 2021-2022

Thus, the MDL depreciated by 7.66% against the USD (from 17.7452 to 19.1945). As for the EUR, on the contrary, it appreciated by 1.09% (from 20.0938 to 19.8744). This is the reflection of the fact that at the world markets the EUR weakened against the USD and even was cheaper than the American currency for some time in June. This situation seriously affects the Moldovan economy as well.

The National Bank of Moldova cannot influence the tendencies of the world economy; that is why it tries to mitigate the effects of the world crisis for an open economy country separately with the tools at its disposal. It should be understood that the main "accelerator" of inflation in Moldova is the cost of energy. But there is also a monetary component, though not dependent on our central bank: annual inflation in the euro area in June amounted to 8.6%; in the U.S. - 9.1%.

In our circumstances, when we are totally dependent on energy imports, which are almost entirely in U.S. dollars worldwide, this means that in those almost 32% of inflation, which was registered in Moldova in the first half of the year, almost a third was imported to us.

A meeting of the Management Board of the NBM on monetary policy is scheduled for early August. We should most likely expect a change in the base rate. But it is impossible to curb non-monetary inflation by monetary methods alone, only to slow it down. The rest depends on other factors: political, geopolitical, geo-economic and others. But even a small energy-dependent country can sometimes prove itself and try to soften the blow to its citizens that the modern world bears. //27.07.2022 - InfoMarket.