Raising rates to fight inflation: what awaits us by the end of the year?

Commentary by InfoMarket Agency

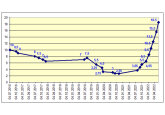

The National Bank of Moldova (NBM) first explained the increase in the base rate over the past year as a need to prevent the growth of projected inflation (in autumn 2021), and subsequently - as a tool to curb and slow it down. Over the year, the base rate rose from 2.65% per annum (August 2021) to 21.5% per annum (August 2022). The increase is unprecedented! But the NBM has followed the rate of inflation growth without trying to catch up with it in absolute figures. Here's how it looks in figures:

|

|

Annual inflation (in % p.a.) |

Dynamics relative to the previous month (in percentage points) |

Base rate of the NBM (in % p.a.) |

Dynamics relative to the previous month (in percentage points) |

|

Ian-2022 |

16,6 |

2,7 |

8,5 |

2 |

|

Feb-2022 |

18,5 |

1,9 |

10,5 |

2 |

|

Mar-2022 |

22,2 |

3,7 |

12,5 |

2 |

|

Apr-2022 |

27,1 |

4,9 |

15,5 |

3 |

|

Mai-2022 |

29,1 |

2,0 |

18,5 |

3 |

|

Iun-2022 |

31,8 |

2,7 |

18,5 |

0* |

|

Iul-2022 |

33,6 |

1,8 |

21,5 |

3 |

|

Weighted average monthly dynamics |

2,81 |

|

2,14 |

|

* In June 2022, the NBM did not take monetary policy decisions. Therefore, if the weighted average dynamics is calculated on the basis of the six months when changes occurred, it will be 2.50 percentage points.

While presenting the quarterly inflation report last Wednesday (August 9), the NBM Governor Octavian Armasu looked more optimistic than in the previous report three months ago. He stressed that the latest increase in the base rate to 21.5%, approved on August 4, is likely to be the NBM’s last decision aimed at tightening monetary policy. The main purpose of this decision is to create conditions for us to enter the downward trend of inflation in October-November, if there are no new shocks.

"Yes, it can be hard and painful, but we have to pay this price now so that there won't be worse consequences in the future," Octavian Armasu said. - He noted that the current circumstances are such that if we can't moderate inflation now, then inflation could become permanent, with new inflation cycles dictated by rising wages, rising lending and social benefits. And if inflation becomes permanent, it will be very difficult to curb it and it will be much more difficult to create conditions to stimulate economic growth. Each problem has its own stage of solution. Now we need to moderate inflation, wait until it goes down, and then start to create new conditions for economic recovery and growth.

The reversal of the inflation upward trend with the downward trend does not mean a decrease in prices, but it does imply a halt in their further growth. That is, prices, having risen on this wave, will never be the same again, but it is good when their growth is stopped. In the future, it is possible to lower them as an adjustment. To do this, the NBM must lead these processes, and the main method is to reduce consumption as much as possible by sterilizing the money supply: if companies and the population have no money – there are no costs, no increase in inflation. But there is no economic growth either.

If we abstract from macroeconomics and the actions of the regulator, and look at what trends are present in the economy, business, and microeconomics (people's pockets), we can highlight several disturbing points.

First, it is no secret that inflation around the world began for two reasons, a small one and a large one: post-COVID-19 pent-up demand with an overlay of accelerated printing presses primarily in Europe and the United States, and the global energy crisis. This manifested itself in the summer and was felt in the fall of 2021. And from February 2022, a third reason joined these two – the military actions in Ukraine, followed by sanctions, and so on.

The global economy as a whole, and we in particular, would have coped with the post-COVID-19 pent-up demand. According to very conservative estimates, inflation in developed markets would have been 3-5%, while in ours it would have been 10-15% per annum. The energy crisis added a third to these figures, and the military actions added at least another third. This, of course, is not certain. Besides, we don't know yet how the world, especially Europe (energy-wise) and Asia and the Middle East (food-wise) will survive the coming fall and winter.

But we clearly see that Moldova is among the world leaders in terms of inflation growth. And both, the NBM and commercial banks, as well as the mentality of Moldovans, play a role in this.

On the one hand, the NBM sterilizes the money supply, trying to force the population to spend less and to deposit money in banks. No spending - no sales - no price increases.

But the banks are not in a hurry to play the NBM's game. The NBM is raising the base rate by 3 points, while the banks are raising the base rate by 1-2 points on loans and deposits. For example, by the end of July (based on the previous base rate of 18.5% per annum and inflation of 31.8% per annum), the maximum rate on the most expensive loans (consumer loans to individuals) comes to 21% per annum (for clients with official income), while for legal entities - 16-18% per annum (in the presence of collateral). At the same time the most profitable deposits, usually those of individuals, were offered in July at a "slow" 13-14% per annum. All rates are below inflation and "walk" around the base rate of the NBM with a minimum margin of commercial banks.

InfoMarket Agency wrote that most of the commercial banks’ profit this year accounts for the income from the government securities market, where the rate is about 20% per annum, as well as at the expense of interest from the National Bank for the compulsory reserves placed there, today it is 16.3% per annum. Lending is more risky and costly kind of activity for a commercial bank.

Many Moldovan residents, observing the galloping inflation and the depreciation of their savings, increase pressure on consumption: first of all, they make pent-up purchases at "old" prices. And very often they resort to the mechanism of lending. Many retail outlets for durable goods have long applied the practice of the so-called "zero" lending in partnership with financial institutions. Therefore, the price of goods on the shelf already incorporates both the interest rate (usually high, since the matter concerns consumer loans), and the additional benefit of the outlet. Psychology is based on the fact that the buyer believes that he/she is buying goods "at 0% per annum", because on the price tag he/she sees the same figures as in the lending contract for 6-24 months.

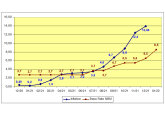

The growth of "zero" lending is also spurred on by the fact that, against the backdrop of galloping inflation, sellers have doubled or even tripled their prices (probably so as not to raise them later). So it turns out that, on the one hand, the NBM, by raising the base rate and reserve requirements, is doing everything to reduce consumption and lending, but on the other hand, it has stimulated them.

|

|

Total new loans issued in MDL |

Dynamics to the same month last year |

Share of individuals |

Loans to individuals in mln. MDL |

|

Dec-2021 |

4701,9 |

41,40% |

38,5% |

1812,1 |

|

Ian-2022 |

2822,1 |

33,50% |

40,9% |

1154,2 |

|

Feb-2022 |

4023,8 |

50,50% |

35,4% |

1424,4 |

|

Mar-2022 |

4534,4 |

29,10% |

31,9% |

1446,5 |

|

Apr-2022 |

3672,5 |

0,70% |

36,4% |

1336,8 |

|

Mai-2022 |

4120,2 |

24,50% |

37,7% |

1553,3 |

Not only was a growth of lending in the whole system registered, but also a stable trend to increase the share of loans to individuals. (It is a pity that the data for June will be available only in the third decade of August).

The National Bank, of course, sees all this. It also understands that the demand for durable goods and lending growth has reached or is about to reach its peak, especially on the background of the last increase by 3 percentage points (to 21.5% per annum) of the base rate and reserve requirements for funds attracted in MDL (up to 40%) as well as in foreign currency (up to 45%).

There are still some factors that may influence the inflation: gas prices, prices for petroleum products, the broken global export-import logistics. If logistics, though with a rise in the cost of production is gradually getting better, and the cost of petroleum products after the June surge is gradually normalizing, the question of gas prices remains. In August the purchasing price was $1458 per 1000 cubic meters (a record!), which is 48.8% higher than in July ($980). Yes, the gas price formula changes in winter and the price is usually lower than in summer, but it is still a factor of uncertainty for us, including in terms of its impact on the inflation level.

There is another important aspect that is affected by the NBM's decision to raise the base rate - the domestic economy. The National Bank admits that rising rates are hindering the country's economic development, but it sets priorities: first we will calm down the inflation growth and subsequently we will loosen the monetary policy "to support the recovery and development of the economy in 2023," says NBM Governor Octavian Armasu.

The problem is that since February-March, business either slowed down or stopped many investment projects. Also, it is to be understood that, on average, 40% of the newly issued loans in Moldova are issued for trade, which is highly susceptible to the results of the goal pursued by the National Bank: to reduce consumption. Under external and internal factors, a business breaks down easily and quickly, and recovers much more difficult and longer.

And if in the first half of the year there was registered an increase in tax deductions to the budget by almost 30%, we have to understand that this increase was only due to higher prices, not to an increase in sales of commodities, and certainly not to the economic growth. According to the results of the second half of the year we will see the real state of affairs, the state of the already weak Moldovan business that forms the state treasury.

Speaking about inflation, we cannot fail to mention one more "anomaly" of our country: Why does Moldova have some of the highest prices in Europe, especially for food products? For example, eggs in the neighboring Ukraine are three times cheaper, and Moldovan goods on the shelves of Romania’s stores are sold cheaper than in Moldovan stores? This "anomaly" also affects the growth of inflation in the country, and perhaps it should be identified and eliminated.

They say that already this autumn the European Union will start helping us very much with the programs implemented in Bulgaria, Romania, and Poland, including programs to support the development of small and medium-sized businesses, the essence of which is that an entrepreneur can receive a grant from the EU in the amount of 30-80% of investments (depending on the industry) if after a certain time he/she is able to develop his/her business on the basis of these investments up to the indicators agreed with the donor. The most successful country in this regard was Poland, which has mastered almost all allocated European funds under such programs, but in the Balkans there were significantly fewer people with entrepreneurial spirit, and there remain a lot of untapped grants.

Concerning Moldova, the question is about how many people, able and willing to do business, still remain in this country. Although the successes of the PARE 1+1 program, when the state provides an entrepreneur with up to 200 thousand lei in a grant, with the condition that the entrepreneur invests a similar or larger amount, are a little encouraging.

Returning to inflation, let us note that the NBM in its forecast said the inflation could reach (according to the pessimistic graph) the projected maximum of 37% per annum in the 4th quarter. And the same forecast shows a return of inflation within the set limits (5% per annum plus/minus 1.5 percentage points) by the end of 2023.

And finally, some funny facts about inflation:

- The highest inflation rate in Moldova was recorded in 1992 - 2705.7% per annum (this is not a typo).

- In late November 1993 the national currency was put into circulation and inflation was 104.6% per annum; it has not been higher since then.

- The highest inflation rate in Moldova, as an independent state, was during the first world economic crisis in 1999 - 43.7% per annum.

- The lowest inflation rate in Moldova, 0.4% per annum, was recorded twice: in 2009 and 2020.

- During 31 years of modern Moldova's history, the National Bank of Moldova only five times has managed to stay within the limits of the level set by the monetary policy, which is defined as 5% per annum plus or minus 1.5 percentage points (from 3.5% to 6.5%): in 2001 - 6.3%; in 2002 - 4.4%; in 2012 - 4.1%; in 2013 - 5.2%; in 2014 - 4.7% per annum. //11.08.2022 - InfoMarket.