“The misappropriation of Repromed's resources, image and trademark by Aidmed allowed Aidmed's owner to misappropriate almost 72 million lei in dividends for 2022 alone” - Cristina Mosin, co-owner of Repromed

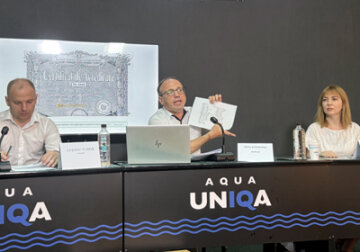

In continuation of the topic about the deliberate bankruptcy of Repromed, at a press conference on Wednesday, Cristina Mosin said that with the onset of her father's Covid illness in 2020, the process of transferring all revenues from the services provided by Repromed (which had 2 owners with 50%/50% shares - Veaceslav Mosin and Alina Hotineanu) to Aidmed company, whose sole owner is Alina Hotineanu, started. According to Cristina Mosin, the Repromed trademark, the company's human resources, premises, equipment are used, and the payment for services is made by clients to Aidmed accounts. According to Cristina Mosin and her lawyer Radu Dumneanu, Aidmed, while receiving accreditation in the field of outpatient and inpatient consultative and coursework medical care, using double accounting, the materials of which have been submitted to the law enforcement bodies, paid salaries on behalf of the responsible employees of Repromed to the chairman and members of the accreditation commission. The lawyers argue that there is every reason to believe that this Aidmed accreditation was obtained illegally, through corrupt means. Moreover, Aidmed received this accreditation for the premises belonging to Repromed, although “from the medical and technical point of view, the functioning of two private medical institutions in the same premises with the same activities is impossible and illegal; for example, there are special rules for the storage and use of narcotic substances,” said Cristina Mosin. At the same time, the lawyer Radu Dumneanu noted that Aidmed does not have the necessary authorization documents for the use of psychotropic and narcotic substances. Cristina Mosin emphasized that currently “patients are at great risk, and in case of any incidents/negligence, it will be impossible to find the culprit”. According to lawyer Tudor Leşanu, one of the steps in the implementation of Repromed's deliberate bankruptcy plan is the insolvency lawsuit for 260 thousand lei. “The only purpose of this case is to keep the situation of withdrawal of Repromed's assets under the control“of the temporary administrator appointed by the court at the request of this creditor,” the lawyer said. At the same time, he drew attention to the fact that, according to the law, such a case should be considered within 60 working days, whereas 8 months have already passed since the beginning of the hearing and the next hearing is scheduled for October, which will amount to 238 working days. Tudor Leşanu emphasizes that since 2022, the owners of the 50% stake in Repromed “have no access to the decision-making processes of the company and no access to information about its activities”. Cristina Mosin and her lawyers reported that investigations have been launched by various authorities and expressed the hope that their results will not be delayed and will subsequently be presented to the public. // 24.07.2024 - InfoMarket.