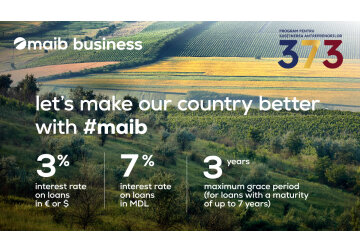

Let’s make our country better with #maib.

We are thrilled to announce that maib joined the "373" program, launched by the Government of the Republic of Moldova to support entrepreneurs.

The program for supporting entrepreneurs "373" is a project through which micro, small and medium-sized enterprises in Moldova can obtain affordable long-term investment loans. Thus, the interest rate on loans in foreign currency is 3% and national currency - 7%. For loans with a maturity of up to 7 years, the maximum grace period is 3 years. The interest rate difference will be subsidized by the Government of the Republic of Moldova through the ODA.

Conditions:

Amount - up to 15 million MDL or the equivalent in foreign currency;

Term - between 3 and 7 years;

Own contribution - minimum 10% of the value of the investment project, excluding VAT.

First come, first served. Eligible applicants will be selected according to this principle. Acceptance of loan applications takes place according to the consecutiveness of applications registered in the program. Apply as soon as possible because the program has a funding limit.

Eligible fields of activity:

- - agriculture, forestry and fishery;

- - manufacturing industry;

- - production and supply of electricity and heat, gas, hot water and air conditioning;

- - water distribution, sanitation, waste management, and decontamination activities;

- - transport and storage;

- - accommodation and food service activities;

- - information and communication;

- - professional, scientific and technical activities;

- - arts, recreation and leisure activities;

- - învățământ

- - health and social care.

Advantages:

- - easy access to resources and state support through interest compensation;

- - advantageous interest rate;

- - guarantee of up to 40% of the loan amount if you do not have sufficient collateral through the Credit Guarantee Fund (FGC) in the ODA portfolio;

- - no early repayment fee.

Choose maib in the Program for supporting entrepreneurs "373", and you get:

- - loan approval within up to 3 days, without physical presence at the branch;

- - the possibility to digitally sign loan agreements;

- - approval of a higher limit, in which more than one loan can be used (without updating the pledge agreements);

- - the possibility of receiving resources from all external lines available in the Republic of Moldova;

- - registration of the mobile pledge directly with the bank without the need to go to a notary;

- - possibility to make payments to maib customers at any time, including weekends;

- - the largest number of customers;

- - the largest network of partners;

- - transparent pricing;

- - customer satisfaction.

Apply now for loans under the online and develop projects, expand your business.

Let’s make our country better with #maib!

With maib it's simple and easy!