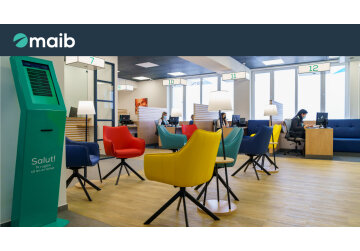

The Balti Branch aligns with the updated maib brand identity - more color and convenience

Customized approach for each customer, smartly designed service areas, comfortable, colorful ambience and innovative business model. These are just a few of the improved aspects of the Balti Branch, transformed in line with the promise of a customer-oriented brand.

Giorgi Shagidze, maib CEO

„Our main goal in transforming maib branches is to deliver renewed customer experiences - experiences that derive from our customer centric strategy, transparency, innovation, agility, professionalism, trustworthy and team spirit. We aim to be not just a bank, but a partner for the whole life of customers, to be close to people, their families and their businesses whatever they do and wherever they are. The Balti Branch is one of the biggest in our network and we are glad that people in this region will benefit from better banking services and products. Their interaction with maib will become even simpler, faster and easier.”

The first thing our customers will notice is the exterior and interior styling, which has become more friendly, welcoming, transparent, comfortable and tailored to customers' needs and expectations. The service areas have also become modern and simplified, where customers can carry out operations on their own, request support from the customer consultant who will determine their individual needs for banking services, provide support, advice and guide them to one of the 4 special areas.

Self-service area - dedicated to fast banking operations for customers who want to do autonomously and in a short time certain operations at payment terminals, such as: paying bills, paying credit, checking account, depositing cash in the account, etc.

Transactional area - allows to facilitate several operations at a single counter, with faster service for a wide list of operations and, implicitly, saving valuable time for everyone.

The advisory area is semi-private, facilitating direct communication, analysis of the needs and complex personal or business development plans. This area is more relaxing, suitable for making important decisions, such as those related to mortgages, business loans and the like.

Premium area – reflects an original concept, offering guests exclusive services, unique experiences in maximum comfort and special privileges. Each Premium Banking client will be assisted by a personal manager and will be able to benefit from a range of facilities combined in the most optimal ways - concierge services, dedicated telephone line, customized mobile application, individual banking services and products on preferential terms, dedicated events, bonus programs and other benefits.

Aliona Stratan, maib First Deputy CEO:

„We are pleased to announce that with the renovation of the Balti Branch, we have developed for the first time the concept of Premium Banking service for individual customers. It defines not only the dedicated product range, but also the operational business model by implementing the ONE STOP SHOP concept. Confidentiality, security, convenience and efficiency are key attributes that make Premium Banking stand out. Now we will be even closer to our customers, helping them enjoy every stage of their lives.”

The Balti Branch, located on 56/a Pushkin Street, is the second branch renovated according to the new maib brand identity. The first branch modernized in this style was the Buiucani Branch in Chisinau. We invite you to visit the Balti Branch every day from Monday to Friday, between 08.30 and 16.30.

For more details and information about the new maib brand identity click on the link.

About maib

Maib is the largest bank in Moldova, with 59 branches and 86 agencies throughout the country. Of these, 22 branches and 32 agencies are located in Chisinau, and 37 branches and 54 agencies are evenly distributed throughout the country.

Through its vast branch network, maib serves about one million customers- corporations, small and medium-sized enterprises, individuals.