The authorized capital of the state-run Energocom will be increased by another 4 billion lei by means of an additional issuance at the expense of funds allocated to it from the state budget.

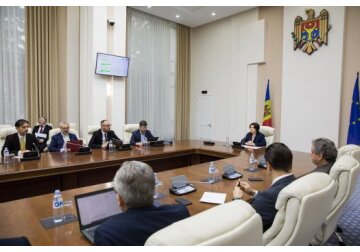

Such a decision was approved by the Commission for Emergency Situations in order to ensure energy security by increasing Energocom's ability to buy natural gas and electricity. The Commission approved an amendment to the Law on State Budget for 2022, providing for the allocation of 4 billion lei to Energocom to increase its authorized capital. It is stipulated that upon request of the Public Property Agency, the Ministry of Finance will ensure immediate transfer of these funds to the bank account of Energocom. In deviation from the Law on joint-stock companies, the Law on Financial Market National Commission (CNPF), the Law on state registration of legal entities and individual entrepreneurs Energocom will send the documents for the additional issuance of shares to CNPF only to notify and make the appropriate entries in the Register of Securities Issuers. CNPF will register the relevant changes in the deviation from the current legislation and will take the decision without charging the relevant fees and duties. The Single Central Securities Depositary of Moldova will not charge any fees for the registration of these shares of Energocom. The funds intended for increasing the authorized capital of Energocom can be used until the changes to the company's authorized capital are registered with the State Register of Legal Entities. // 14.11.2022 - InfoMarket