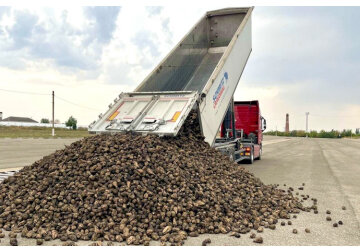

Is the sugar market in imbalance? How can Moldova avoid ahortages and exorbitant prices?

Despite the efforts of local producers, the domestic sugar market remains deficient. Sugar consumption is inelastic and amounts to approximately 75,000-80,000 tons annually, with the largest share being held by household consumption and industrial processors, reports IPN.

In recent years, the two sugar producers have been unable to secure the necessary raw materials and, consequently, have failed to supply the domestic market with sugar at prices comparable to those abroad. It is worth noting that retail prices in European markets are around €0.8/kg or 15.5 MDL/kg, whereas in Moldova, these prices often exceed the threshold of 20-21 MDL/kg in commercial networks. This situation is a burden for household consumers and, more significantly, for the food processing industry, which actively uses sugar as a raw material. Any additional cost leads to an increase in the prices of finished products, a loss of competitiveness, and a reduction in market opportunities, both local and external.

Forecasts for 2025 are not optimistic, and expectations regarding climatic conditions are grim. Moreover, there is a growing trend among farmers to shift towards other annual crops rather than sowing sugar beet. Preliminary data from district councils indicate that only 10,000-11,000 hectares have been contracted for sugar beet cultivation, which is at least 30% less than in previous years. With an average yield of 40-45 tons of beet per hectare, only 50% of the raw material needed for sugar production can be secured.

Thus, to avoid shortages in the domestic market, imports are imminent. However, to ensure price stability, these imports must be conducted under preferential regimes, free of customs duties, specifically from EU countries and the Western Balkans, particularly Serbia, which has significant potential in the field and can offer sugar at a reasonable price for the domestic market.

It is worth noting that Serbia is a complementary market to Moldova’s: in years when Moldova has an overproduction of sugar, Serbia absorbs a large portion of the surplus, while in years of domestic shortages, Serbia becomes a reliable and stable supplier of sugar at affordable prices for consumers and businesses.

An analysis of data from the first three months of 2025 shows that the largest share of sugar imported into Moldova comes from companies with a significant presence in the local production sector. Of the more than 20,000 tons of imported sugar, approximately 90% was brought in by just three companies.

Under a restrictive quota system and high customs duties—up to 75%—the access of other economic operators to imports may be limited, reducing the possibilities for diversifying the supply in the domestic market.

The lack of investment in the sugar industry, excessively high production costs compared to those in the region (both EU and non-EU countries), low productivity per hectare, and the absence of a long-term dialogue and stability in securing raw materials for this industry lead to high domestic production costs that are excessive, unjustified, and unaccepted by the domestic market.

Moreover, the lack of restructuring in this sector, the physical and moral depreciation of equipment, the shortage of raw materials for processing, and emerging trends and business models make Moldova's sugar industry uncompetitive, unsustainable, and a significant burden on the state and consumers.

The current situation raises a significant dilemma: should Moldova protect the two local sugar producers by maintaining high barriers at the risk of increasing domestic prices—directly affecting consumers and the entire sugar-dependent food industry? Or, on the contrary, should Moldova ensure a balanced import regime, adapted to the real needs of the market, to maintain competitive and predictable prices for both local producers and all other processors in the food industry facing cost pressures?

It should be noted that the current sugar imports, mostly carried out by local producers themselves, do not harm their interests. On the contrary, the imported volumes correspond to domestic demand, and transactions are conducted in accordance with international commercial practices, without indications of unfair or anti-competitive behavior.

Negative Trends and Reflections

Fierce competition in the industry has driven new trends in the EU sugar market, including the closure of unprofitable sugar factories unable to secure raw materials at competitive prices, the consolidation of sugar production in countries with higher productivity levels and lower climatic risks—especially in Northern Europe—and the restructuring and acquisition of businesses by large multinational corporations.

In Moldova, in recent years, there has been a continuous reduction in cultivated sugar beet areas—from 28,000 hectares in the 2000s to 10,000-11,000 hectares in 2025. This reduction cannot guarantee the necessary volume of sugar beet for local processors, whose numbers will continue to decline, and thus, domestic sugar production will not meet market demand. It is, therefore, inexplicable that while the purchase price of raw materials (sugar beet) in European countries is approximately €35/ton, in Moldova, due to various factors, the price acceptable to farmers is around €50/ton, making the entire business model inherently risky. In other words, the domestic market tends to be permanently deficient, with expectations of rising prices, and the shortfall can only be covered through preferential imports (exclusively from the EU and CEFTA countries). All other sugar-exporting countries are ineligible for free trade with Moldova, particularly Ukraine, from which Moldova receives no commercial preferences for sugar imports.

Local producers prioritize imports (from parent companies or other sources) over investments in the local value chain, from cultivation to processing. This reorientation erodes the foundation and future of the domestic industry and constitutes unfair and anti-competitive practices. Without clustering this sector by integrating farmers into the production cycle, establishing an efficient irrigation system, and modernizing all production processes, the industry’s performance cannot be guaranteed.

Global and regional trends suggest that, in the medium term, the local industry’s capacity to fully meet domestic sugar demand remains limited. In this context, the necessity of reconsidering import policies is becoming increasingly evident: would it be beneficial for Moldova to establish a fairer and more predictable framework for sugar imports, addressing market needs under accessible and competitive conditions for all interested stakeholders? These are questions that deserve an open, well-reasoned discussion focused on the public interest.

https://www.ipn.md/en/is-the-sugar-market-in-imbalance-how-can-moldova-avoid-7966_1113466.html