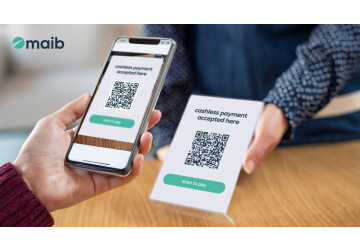

With a simple QR code, you can accept payments. Maib announces the launch of a new service for traders

Do you sell online on Instagram and other internet platforms but still don't have a bank card payment option for your customers? Now, you can accept card payments online and offline by giving your customers a QR code.

It's simple. You generate a QR code for the product or service being delivered, and your customer makes payment by scanning this code with their phone. Payments will be made with Google Pay and Apple Pay payment options, Visa, Mastercard and American Express cards.

What businesses are QR code payments suitable for?

- 1. Trade fairs, exhibitions and festive events;

- 2. Travel agents and hotels;

- 3. Private consultations, training, coaching, supplementary lessons;

- 4. Car rental;

- 5. Horeca, bakery, coffee shop etc.

How do you integrate the QR payment service into your business?

You can request the activation by two methods. Choose which is more convenient for you.

First method:

- 1. Fill in the registration form, and a maib representative will contact you shortly.

- 2. Open the necessary accounts at maib, and you will soon receive access to your cabinet.

- 3. Access the personal cabinet at https://maibmerchants.md/login and generate a QR code.

Second method:

Call 1314 or message us at contact.business@maib.md, and a maib specialist will contact you shortly.

With maib, it's simple and easy to accept payments!