Government doesn’t support the draft law on allowing patent-based trading until the end of 2024.

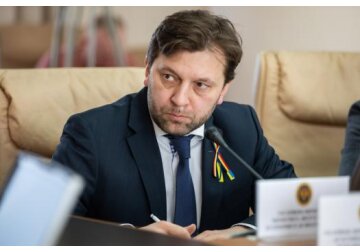

The Cabinet of Ministers issued a negative opinion to the legislative initiative of MP Alexandr Nesterovschi. Deputy Prime Minister, Minister of Economic Development and Infrastructure Dumitru Alaiba noted that former patent holders had enough time to switch to other forms of activity, including registering as individuals with independent activity. He reminded that there are a number of privileges and opportunities for this form of registration: the tax rate is 1% of sales, the maximum sales volume is increased to 1.2 million lei per year, there is no bookkeeping and minimal reporting is required. This type of activity requires the use of cash register equipment connected to the "Electronic Sales Monitoring" system. At the same time, until the end of August, the patent holders, registered as private individuals with independent activity, can receive compensation for the costs of cash register equipment and other expenses. Alaiba emphasized that this reform will not be stopped or postponed, as the patent-based trading activity restricts the rights of consumers of goods and services, carries risks of tax evasion and under-receipt of budget revenues, stimulates the shadow economy and promotes disloyal competition. According to Alaiba, more than 1.5 thousand former patent holders have already registered as independent entrepreneurs. It should be noted that the patent reform affected about 5 thousand patent holders entitled to retail trade, or 40% of all patent holders in the country. At the same time, holders of trade patents provided about 60% of all tax payments made by patent holders (according to available data of the State Tax Service (STS) for the first quarter of 2023 - 6.1 million lei). At the same time, according to the STS data, in the first half of 2023, individuals carrying out independent activity in retail trade paid income tax of 3.5 million lei. // 03.08.2023 - InfoMarket.