Sugar market in crisis: domestic production is falling and prices are rising!

The situation on the sugar market in the Republic of Moldova has repeatedly become a topic of discussions in recent months, including in view of the difficult situation in the sector in 2024 and the inevitability of price increases. Today, there are enough reasons to assume that the market will remain uncertain not only in 2025, but also in the following years. Even a brief analysis of the state of affairs in this market leads us to the only possible conclusion - it is necessary to comply with regional trends and improve the competitiveness of the industry. And if we do not take the necessary actions, the situation in this important area will continue to deteriorate, and we will all feel the consequences. But let us consider the situation in sequence.

Today, the Moldovan sugar market is extremely volatile and is affected by a combination of internal and external factors, taking into account both local production and imports. The Moldovan sugar sector is dominated by two key producers who play an important role in the production, import and sale of sugar on the domestic market. These two producers will have to take into account certain factors. First of all, it should be noted that domestic sugar production is very limited compared to domestic market consumption and available export potential. This is due to several factors, including the climatic conditions affecting sugar beet production and the ever-decreasing area of agricultural land devoted to this crop. Thus, we see that Moldova cannot satisfy all domestic demand through local sugar production and is largely dependent on imports.

Sugar consumption is inelastic and mainly depends on consumers in the food industry who use it as a raw material. According to the statements of sugar producers, in recent years the internal consumption, including the Transnistrian region, is about 78-80 thousand tons (volatility +/-8 thousand tons depending on the food industry indicators). In addition, it should be noted that due to the instability and seasonality of this product, Moldova should also have a transit buffer stock of at least 15 thousand tons.

|

In 2024, about 14.5 thousand hectares were sown with sugar beet in Moldova, but due to severe drought, only 230 thousand tons of sugar beet could be harvested. This is 28% less than in 2023. Thus, it was possible to produce about 28 thousand tons of white sugar or something more than 30% of the domestic market demand. |

Following recent decisions and announcements by domestic food producers of price increases due to rising raw material costs and expectations of higher sugar prices, there was further uncertainty about the prospects for the current year.

Climatic changes, the ongoing crisis in agriculture, and international trends of regionalization of sugar production depending on efficiency have affected the fact that domestic producers have been unable to supply the domestic market with domestic products. The deficit is covered by imports, which have been steadily increasing in recent years.

It is estimated that the maximum volume of sugar production may be up to 50 thousand tons. Moreover, in order to optimize costs and efficient use of production factors, Moldova will be able to launch only 1-2 sugar factories out of 6 available in 2005 (sugar factories in Drochia, Cupcini, Glodeni, Alexandreni, Donduseni and Falesti). At the same time, a part of the market and costs will be substituted and covered by imports. Thus, the tendencies of substitution of domestic consumption with imported products at a lower and more competitive price will continue. The situation will be much worse in case of a repeated drought. The consequences for agricultural producers and domestic companies in the sugar industry will be catastrophic.

On the other hand, it should be noted that the domestic sugar market remains extremely protected due to the policy of stimulating and supporting the local industry. Imports are subject to customs duties of 75% of the value of the goods and VAT of 8% or 20%, depending on the origin of sugar - from cane or sugar beet.

The situation is somewhat alleviated by the fact that import tariff quotas with full or partial exemption from customs duties on imports are applied on the basis of free trade agreements signed with the CIS countries, CEFTA, EFTA, as well as the Association Agreement with the EU.

|

According to information received from importers, for 2025 the current orders for sugar beet seeds are placed for sowing 11-12 thousand hectares, or 15-20% less than in previous years. With an average yield in recent years of 35-37 tons of sugar beet per hectare, it is clear that this will not be enough to load production capacity by at least 40%, nor to cover the demand for sugar on the domestic market. |

|

Under these conditions, the largest imports of sugar under preferential treatment were recorded in 2024 - about 31.8 thousand tons. Most of the imports - 16.7 thousand tons or 57% - were from EU countries (Germany, Belgium, Poland, Lithuania, Romania, etc.), Great Britain and 15 thousand tons from Serbia on the basis of the CEFTA Agreement.

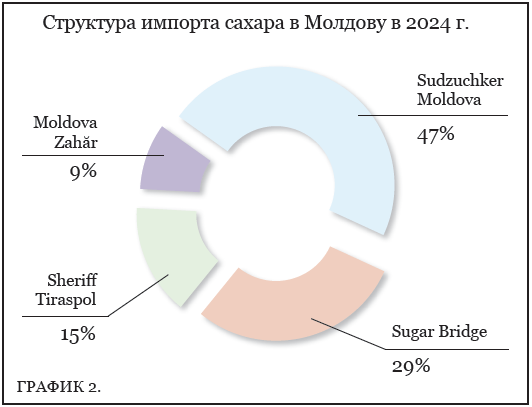

The most paradoxical thing is that 2/3 of imports were made by domestic sugar producers: Sudzucker Moldova - 15 thousand tons or about 50%; Moldova Zahar SRL - 2.9 thousand tons or 9%, as well as other local traders, especially Sugar Bridge SRL - 9.4 thousand tons or about 32% and the Sheriff Company from the Transnistrian region - 4.9 thousand tons or about 17%.

Thus, for the first time since the signing of the Central European Free Trade Agreement (CEFTA), Moldova registered massive imports of sugar from Serbia totaling more than 15 thousand tons. Paradoxically or not, the largest importer of sugar from Serbia was Sudzucker Moldova S.R.L., which imported more than 80% of this quantity. Under such conditions, Sudzucker Moldova S.R.L. undoubtedly benefited the most from the existence of the CEFTA Agreement, while imports from Serbia represented a “lifeline” for the Moldovan domestic market against shortages and accelerated price increases.

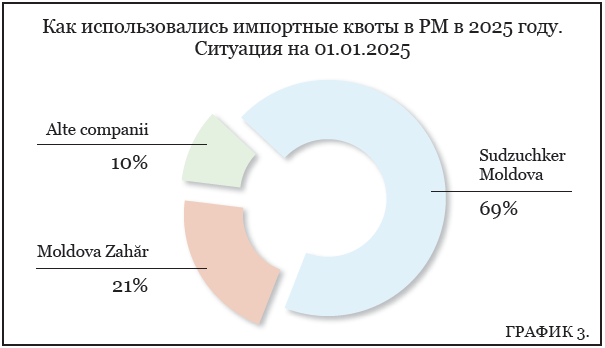

The trend of massive sugar imports continues in the first months of 2025. However, an acute problem is the way of managing tariff quotas - in the first hours of 2025, customs import declarations were filled for 15.5 thousand tons of sugar, most of which is consumed by local sugar producers: Sudzucker Moldova - 10.4 thousand tons and Moldova Zahar SRL - 3.5 thousand tons, another 1.6 thousand tons - by others.

CHART 1

Domestic market structure 2024 - 78 thousand tons

Buffer stock

Internal process

Import

Structure of sugar import to Moldova in 2024

At the same time, it should be noted that today the sugar market in Moldova is dominated by a strong combination of imports and domestic production, which is constantly decreasing, and imports are becoming the “core” and the essence of business. Moreover, the main players in this market are domestic sugar producers who are reorienting their business model from production and sustainability of the agricultural sector, growing sugar beet, to mass imports from parent companies or intra-corporate imports. There is a growing lack of interest to build a sustainable and integrated business along the entire price chain - from sugar beet growing with contract farmers to processing and marketing in the domestic market.

As far as the outlook for the sugar market is concerned, we must also take into account the international and regional situation. Following the structural changes in the sugar industry and the growth of productivity and competition in the industry, sugar producers in the EU countries are regionalizing and focusing on countries where sugar beet yields per hectare exceed 65 tons or more and capacity utilization exceeds 80%. Thus, production in Central and South-Eastern Europe is closing down and concentrating in the northern countries - the so-called “sugar belt”: Germany, Belgium, France, Poland and the Netherlands. Only Austria, Czech Republic, Serbia and Hungary with average yields of 55-60 tons per hectare will survive in the Central European zone, while the rest of the producing countries (Croatia, Slovakia, Romania), despite subsidies, are following the tendencies of reducing the area, stopping their production and actively concentrating on sugar supplies from more profitable areas or imports from developing countries, taking advantage of European agricultural and trade policy.

Moldova, with a sugar beet yield per hectare of 30-40 tons (about 17 tons in 2024), morally and physically obsolete equipment, cannot withstand growing competition, which is also reflected in export statistics. The Republic of Moldova has commercial export preferences in EU countries, but since 2021 there are no exports, even if the tariff quotas are 37 thousand tons.

Despite the fact that Moldova is becoming uncompetitive on the external market and, therefore, will be oriented towards the domestic market, it is obvious that in the future the domestic industry does not have the potential to supply the domestic market according to the real needs and at competitive prices with respect to imports. That is why a radical change of approach is needed.

First of all, it is necessary to revise the state policy, as well as the policy of sugar producers in the sphere of sugar beet cultivation. Secondly, the mechanism for managing preferential import quotas needs to be revised. It is absolutely abnormal what happens every year - preferential import quotas are used up on New Year's Eve by sugar producers. It is clear that only companies that specialize in this business, especially sugar producers who are also the largest importers, can organize themselves and benefit from the import preferences. All other stakeholders, including industrial consumers, have no chance, also because they lack the necessary infrastructure and liquidity. Also, in addition to revising the mentioned mechanism, it is necessary to initiate appropriate measures to increase these preferential quotas.

How to use structural quotas in RM in 2025

CHART 3

Situation as of 01.01.2025

Other companies

In 2024, competition in the sugar market and imports from CEFTA and the EU saved domestic consumers from price increases that were actively proposed and promoted by domestic producers last fall. But this will not always be the case. Regional risks and pressures are enormous. Therefore, if we want the situation on the sugar market to be as stable and normal as possible and to provide consumers and industrial producers with quality sugar at an affordable, competitive price, it is time to take adequate measures. If we fail to do so, we may witness quite unpleasant, if not serious, consequences.

And here the matter concerns perspectives not in the medium or long term, but in the short term. The strategic vision should be formulated by responsible state institutions, which should structure their agricultural policies based on regional and international trends, the set of available policies and the efficiency of using public money, if providing subsidies is concerned.

Source: LOGOS PRESS