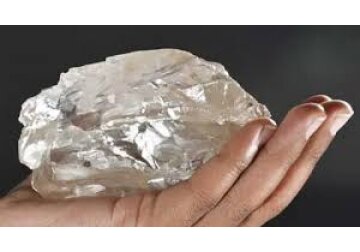

World's second-largest diamond found in Botswana

The second-largest diamond ever found - a rough 2,492-carat stone - has been unearthed in Botswana at a mine owned by Canadian firm Lucara Diamond.

It is the biggest find since the 3,106-carat Cullinan diamond, found in South Africa in 1905 and cut into nine separate stones, many of which are in the British Crown Jewels.

The diamond was found at Karowe mine, about 500km (300 miles) north of Botswana's capital, Gaborone.

Botswana's government said it was the largest diamond ever discovered in the southern African state.

The previous biggest discovery in Botswana was a 1,758-carat stone found at the same mine in 2019.

Botswana is one of the world's biggest producer of diamonds, accounting for about 20% of global production.

In a statement, Lucara said the stone was "one of the largest rough diamonds ever unearthed".

"We are ecstatic about the recovery of this extraordinary 2,492 carat diamond," said Lucara head William Lamb.

The diamond was detected with the use of Lucara's Mega Diamond Recovery X-ray technology, said Mr Lamb.

It has been used since 2017 to identify and preserve high-value diamonds so that they do not break during ore-crushing processes.

The firm did not give details of the stone's gem quality or its value.

However, the UK-based Financial Times newspaper reported that people close to Lucara, whom it did not name, estimated that the stone could be worth upwards of $40m (£30.6m).

The 1,758-carat stone found in 2019 was bought by French fashion brand Louis Vuitton for an undisclosed sum.

A 1,109 carat diamond, unearthed at the same mine in 2016, was bought for $53m by London jeweller Laurence Graff, chairman of Graff Diamonds, in 2017.

Lucara has 100% ownership of the mine in Karowe.

Botswana's government has proposed a law that will ask companies, once granted a license to mine, to sell a 24% stake to local firms if the government does not exercise its option of becoming a shareholder, Reuters news agency reported last month.

Bbc.com