Moldova may introduce taxes on parcels containing goods purchased on Temu, Shein, AliExpress and other marketplaces in the summer of 2026, and they may consist of 20% VAT, customs duties of 5-10%, and a packaging fee - the Ministry of Finance

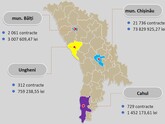

As announced by Finance Minister Andrian Gavrilita, about 50,000 parcels arrive in Moldova from abroad every day, and, according to some experts' estimates, if taxes are levied on them, the budget could receive not 1 billion lei per year, as previously announced, but 2-3 billion lei per year. The head of the Ministry of Finance stressed that it is impossible not to tax imports, but taxation of parcels with goods purchased on various marketplaces should be fair and as comfortable as possible so that ordinary people do not feel a significant difference. According to him, the authorities may introduce a 20% VAT, customs duties ranging from 5% to 10% depending on the tariff position, as well as an environmental fee for packaging for parcels ordered on international platforms. Andrian Gavrilita explained that Moldovan entrepreneurs already pay similar taxes when importing goods. “VAT, customs duty, and packaging fee” are the three taxes that should be included in the final amount. The final cost should be fair,” said the head of the Ministry of Finance. According to him, for example, if the price of a parcel is 180 lei, the 20% VAT will be 36 lei. Customs duties of 5-10% and a packaging fee of 5-10 lei will be added. “Let's say that in the end, this parcel will cost 220-230-240 lei. But the goal is not to reduce access to cheap goods, but to ensure that this cheapness includes a fair tax paid by all businesses that import something, so that this unfair competition is reduced,” Andrian Gavrilita emphasized. He noted that the authorities' goal is not to punish Temu, Shein, AliExpress, or any particular country. “It's a simple practice. When someone imports something into the country, if they don't declare it and don't pay taxes, it's called smuggling. That is, from the point of view of the budget and the effect on the budget, these untaxed imports have the same impact on the budget as smuggling. It's just that these goods come in many small packages and are not taxed, which could go towards salaries, pensions, etc.,” the Finance Minister emphasized. According to him, it is necessary to restore fairness and levy taxes on all imported goods so that the authorities can raise salaries for doctors, teachers, police officers, and other public sector employees. “But if we allow imports without paying taxes, we simply will not be able to survive as a state for long and will not be able to fulfill our responsibilities,” said the head of the Ministry of Finance. He noted that next year, this issue with taxes on parcels with goods purchased on Temu, Shein, AliExpress, and other marketplaces needs to be resolved, and now all other countries in the region are resolving it. “This is a painful issue for everyone, and we must come up with a solution, most likely by next summer, but the only delay in resolving this issue is that we want people to suffer no harm, except that the price of their goods will become a little fairer and the budget will not lose out as a result. Otherwise, nothing should change for them. But the point is that, as a state, we cannot afford to import without taxes, because the state is structured in such a way that it must survive on taxes,” said Andrian Gavrilita. // 17.12.2025 — InfoMarket.