Taxpayers can settle tax liabilities with a single payment using the Contul unic service

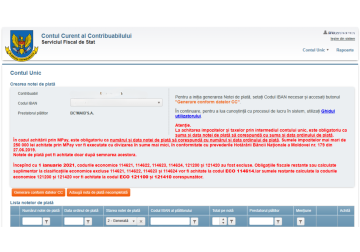

The State Tax Service (SFS) announced that taxpayers can make payments faster and without additional fees with the Contul unic (Single Account) service. It is aimed at improving and simplifying the procedure for repayment of tax liabilities and allows combining several payments into one and making its payment through the state service of electronic payments MPay. The State Treasury decodes the total amount of taxes, fees and other payments paid to the budget by type on the basis of the payment order filled in by the taxpayer. Payment of taxes through Contul unic allows you to significantly reduce the number of payment documents required for execution; save time for preparation of payment documents and save on bank commissions for transfers made; avoid errors when making transfers, etc. The service is available to all taxpayers who have access to electronic tax services, including the information system “Taxpayer's Current Account”. According to statistics on the use of the service, over the past 5 years the number of bills generated and paid through the service is constantly growing - by about 20% per year. Taking into account the growing interest in the service, in December 2024 the Ministry of Finance approved the order on the procedure for payment and accounting of payments to the state budget through the treasury system of the Ministry in 2025 and taxpayers have the opportunity to pay tax liabilities through the “Single Account” module on the basis of a payment order formed in the system “Taxpayer's Current Account”. Guidance on how to use the service is published on the SFS website: https://sfs.md/ro/document/ghidul-privind-utilizarea-serviciului-electronic-contul-unic. // 04.03.2025 - InfoMarket