The Government approved amendments to a number of regulations to improve the financial market infrastructure.

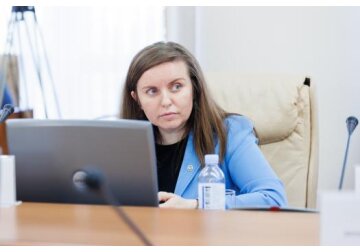

The draft law was elaborated by the National Bank of Moldova (NBM) and promoted by the Finance Ministry to improve the national legislation in the field of financial market infrastructure in order to connect more easily to the EU financial market. As mentioned by the Minister of Finance Veronica Sireteanu, the main provisions of the draft law concern the consolidation of the National Bank's monitoring and supervisory powers in the field of financial market infrastructure and payment systems, clear distribution of the responsibility of regulation and supervision of the Single Central Depository (SCD) of Securities between the NBM and the National Financial Market Commission (CNPF), adjustment of the requirements regarding the connection of the SCD with SCDs in other countries and the conditions of authorization of such connections by the NBM to ensure interoperability, etc. The implementation of this law is intended to contribute to the realization of a number of commitments of Moldova regarding the development of the financial market of the country. As it is mentioned in the materials of the Ministry of Finance, due to the need to strengthen and develop the functions of monitoring and supervision in the field of financial market infrastructure and payments, the National Bank of Moldova benefits from the EU technical assistance - twinning project "Strengthening supervision, corporate governance and risk management in the financial sector of Moldova", financed by the EU. Monitoring the financial market infrastructure and payments in general is a fundamental responsibility of the National Bank. This includes promoting safety and efficiency objectives in the supervision of planned or existing systems, assessing them against these objectives and making changes where necessary. According to international standards, financial market infrastructures should be subject to effective monitoring because they can cause systemic risks if they are not sufficiently protected from the risks to which they are exposed. Accordingly, one of the outputs of the technical assistance project was the development of primary and secondary legal frameworks related to financial market infrastructures and payments, new rules aligned with EU legislation and international best practices. Thus, the system of regulation, monitoring and supervision of the SCD was revised in order to detail its scope of activity, the powers of the NBM and the National Financial Market Commission regarding the regulation and supervision of the SCD were more clearly defined and separated. In addition, the Law on the National Bank of Moldova is proposed to be supplemented with provisions that clearly reflect the monitoring function of the NBM (in terms of definition and powers), and Law No. 114/2012 with details regarding the supervision of payment services. The draft law also proposes to supplement the Law on the National Bank of Moldova with the concepts of payment instrument issuer, financial market infrastructure administrator, management body, payment scheme, payment procedure, as well as activity monitoring; adjusts the basic powers of the NBM in order to cover more clearly the scope of NBM competence, including schemes, mechanisms and payment instruments; grants the NBM the right to apply corrective measures/sanctions to financial market infrastructure participants. Sanctions, including fines for non-compliance with the provisions of the Law on the National Bank and regulations issued by the NBM, are envisaged for entities that fail to comply with the remedial measures prescribed to them. It is stipulated that the maximum amount of fines shall be at a level that ensures the effectiveness, proportionality and deterrent effect of the sanctions and shall be in line with the capital/turnover of the financial market infrastructure/scheme/financial market or its participants. Other amendments to the Law on Payment Services and Electronic Money supplement it with the obligation of the payment company to obtain prior approval from the NBM for outsourcing important functions (according to the guidelines on outsourcing issued by the European Banking Authority - EBA). The Law is complemented by the obligation of the payment company to conclude contracts for audit services only with organizations approved by the NBM, as well as to conduct annually and upon request of the NBM an external audit of outsourcing activities/operations. A fairer formula for calculating the upper threshold of the fine imposed by the NBM on the payment service provider shall also be introduced. In the Law on Capital Market, in the context of clarifying the supervisory powers of the CNPF over the SCD, the obligation to ensure the CNPF's access to the electronic system of the SCD is introduced. The Law on the finality of settlements in payment systems and settlement systems for financial instruments proposed a more precise definition of the concept of “systemic risk” and expanded the list of entities falling under the concept of “institution”, which was supplemented by payment companies or e-currency issuing companies. The Law on the Single Central Depository provides for the separation of the responsibilities of the NBM and the CNPF in the part related to the regulation and supervision of the SCD, namely: the CNPF will be responsible for the regulation and supervision of the SCD in terms of responsibility for the corporate securities market area, while the NBM will be responsible for other aspects of the SCD's activity. At the same time, the NBM's functions were supplemented with the function of monitoring of the SCD as a crucial element of the financial infrastructure (according to the recommendations of the experts of the Twinning project). // 20.09.2023 – InfoMarket