NBM vs. inflation: one warrior in the field?

InfoMarket Agency’s Commentary

The Parliamentary Commission on Budget and Finance summoned the Governor of the National Bank of Moldova (NBM), Octavian Armasu, to its meeting on Wednesday. After hearing his report on the reasons for the strong rise in inflation, Commission members must decide whether or not to ask the Standing Bureau of the Parliament to put the NBM Governor’s speech on the plenary agenda.

Last week, the National Bank submitted its second inflation report and inflation forecast to the public in 2022. The NBM makes such reports on a quarterly basis. The previous one was submitted on February 15. Then the regulator suggested that inflation as of the end of 2022 would be 18.8% per annum, with a peak growth of 20.6% per annum in the third quarter and a return to single digits of 7.1% in 2023.

But February stood out with the outbreak of hostilities in the neighboring country with all the ensuing consequences. That is also why the second inflation report of the National Bank, submitted in May, was more pessimistic. By that time, the statistics announced the inflation rate for the last 12 months (May 2021 - April 2022), which amounted to 27.07%. And according to the forecast of the National Bank in the III quarter inflation could reach 37%, the total for 2022 - 27.3%. Next year's forecast worsened to 16.5%.

Let us remind that the main objective of the National Bank of Moldova is to keep the inflation rate within the limits set - 5% per annum plus/minus 1.5 percentage points, that is, within the corridor of 3.5% to 6.5% per annum. Did the NBM meet this target? Unfortunately, in the context of severe crises, and Moldova in the past two years has passed from one crisis to another and subsequently – to a third one, the National Bank alone cannot cope with inflation without support and joint action with the government. The role of central banks is to influence the economy either by changing the liquidity on the market or by changing the value of money.

What tools does the National Bank of Moldova have to curb inflation? As the NBM conducts a direct inflation targeting regime, the main instrument is the base rate. This measure has a number of aspects. Among them, for example, we can mention the fact that when the base rate increases, deposit rates go up (which means that we can expect an increase in their volume, money will settle in banks and leave the consumer market) and loan rates as well (which means that lending will become less attractive, especially for consumer loans). In early May, the base rate was raised by 3 percentage points (p.p.) - to 15.5%.

Another measure is to increase the norm of the obligatory reserves for attracted resources: each bank is obliged to transfer this rate to the National Bank, thus the NBM regulates the liquidity volume in the market. In the beginning of May, these norms were increased by 2 p.p. to 32% in national currency and to 33% in foreign currency.

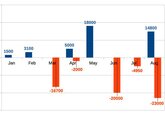

Another monetary policy instrument is currency interventions. They influence the exchange rate and subsequently affect the volume of exports, imports, consumption, as well as the average prices for the above macroeconomic parameters. In addition, the use of interventions in the foreign exchange market directly affects the volume of liquidity, which ultimately leads to lower lending growth. The regulator sold $111.4 million in January, $111 million in February and $213.8 million in March. That is, only during the first three months of the year, through its currency interventions, the NBM sterilized about 7.5 billion lei. There are no data for April, but it seems that the amount of currency interventions will be comparable with the dynamics of the previous three months.

Why did the National Bank suddenly have to fight inflation, moreover, in fire-extinguishing mode? What factors led to the acceleration of inflation in Moldova?

We have already written about it, but we can say it again. Back in November 2020 the world-renowned futurist Michio Kaku, who participated in the Moldova Business Week forum, forecasted inflation in an interview with several Moldovan journalists, among whom the InfoMarket editor was present. In particular, he said that in the midst of the pandemic in 2020, almost all countries have registered deflation due to the forced slowdown of the economy. Michio Kaku drew attention to the fact that many countries have launched printing presses, while others have actively borrowed money. "And there will be a price to pay for this in the near future," Michio Kaku said a year and a half ago, which, in fact, is what happened in 2021. The futurist was right. But what is important: forecasting world inflation in 2021, Michio Kaku urged governments to take measures to prevent inflation from turning into hyperinflation, since all the prerequisites already existed for this.

We must pay attention to the fact that, according to the futurist, the measures should be taken by governments.

The energy crisis, which hit Moldova (let's not speculate about the reasons), launched a flywheel of inflation in the fall of 2021. And just as soon as the country seemed to have tried to absorb the inflationary growth associated with rising energy prices, hostilities broke out in the neighboring country.

The country is totally dependent on the state of affairs in the region, so disrupted ties, rising prices due to increased demand for food for fear of shortages, and related factors have made the country the leader in inflation in the region.

The Economic Press Club asked Octavian Armasu, after he submitted the inflation report in mid-May 2022, why Moldova has an inflation rate of 27.01% per annum, while in the countries that are at war it is significantly lower: in Russia - 17.83% per annum, in Ukraine - 13.7% per annum. The Governor of the NBM said that in Ukraine, under the conditions of war, the exchange rate of hryvnia to foreign currencies was administratively fixed, and the government by its decision froze the prices on a large list of food products and commodities. Therefore, there is no immediate effect of the war on inflation, at least at the statistical level. When the country comes out of the war and these administrative restrictions are gradually loosened, exchange rate and price adjustments will be inevitable. The extent depends on the actions of the government and the National Bank of Ukraine.

"In Moldova there are liberalized prices and a free exchange rate of the MDL, there is no administrative interference. The economy works in a normal mode, so any pressure on it is immediately reflected in the prices," stressed Octavian Armasu.

Speaking of Russia, he noted that the country is a major exporter of energy resources, with a large economy and reserves accumulated in previous years. All this supports visible stability, but under international sanctions such stability cannot be maintained indefinitely and they will affect the economy of this country.

In his speeches, especially regarding the National Bank's struggle against inflation, Octavian Armasu repeatedly said that the NBM and the government must work closely. There are decisions that only the Cabinet can take. And in a situation when the whole world is experiencing an unprecedented inflation (even in the USA the inflation rate is 8.5%, which has not occurred for more than 40 years) the efforts of the regulator alone may not be enough.

Indeed, economists and analysts, including those in social networks, say that the decisions made by the government (gas, electric power, oil products) directly affect the economy and the inflation which so far only the National Bank is struggling with. As we know, and Moldova has been through this already, if a businessman has the opportunity to raise the price of his product amidst the general hysteria, he does it, even if he doesn't have any prerequisites for this and the warehouses are full of goods. Several years ago in Moldova some economic agents were punished by the controlling bodies for unreasonable price increases, and speculations stopped quickly. However, at that time the actions of inspectors were based on certain decisions of the government, which sought to curb speculative pressure on inflation. Is it administrative influence on the economy? - Yes! But as a temporary solution in a crisis, this is how the governments of the most economically developed countries act.

On Wednesday, the Parliamentary Committee on Budget and Finances will hear the Governor of the National Bank and decide whether he has to address all MPs. But, for the sake of justice, and the opposition MPs spoke about this, the Prime Minister should be summoned to report as well, or at least, the Minister of Economy. Their actions or inaction (it's not a secret for anyone) have directly affected the strong rise in inflation in Moldova. If the Cabinet with its administrative resources and the National Bank with its monetary regulation do not join their efforts to combat inflation, the current forecast of the National Bank for this year may seem very optimistic. //18.05.2022 - InfoMarket.