What is happening in the Government Securities Market and what does the National Bank have to do with it?

Commentary by InfoMarket Agency

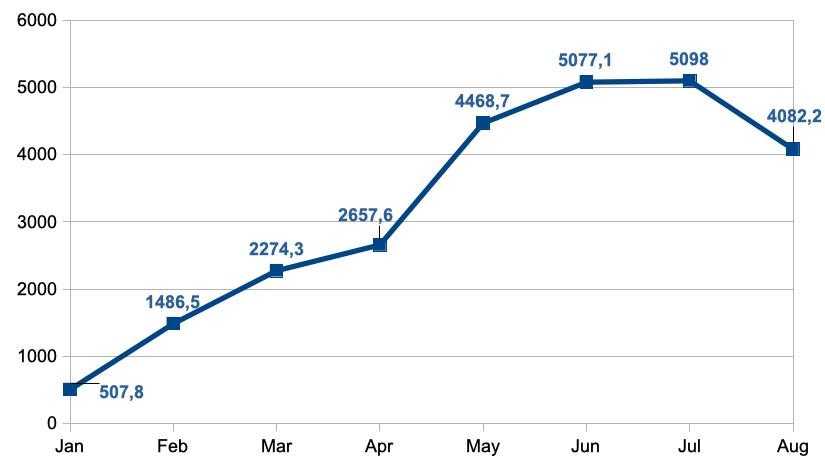

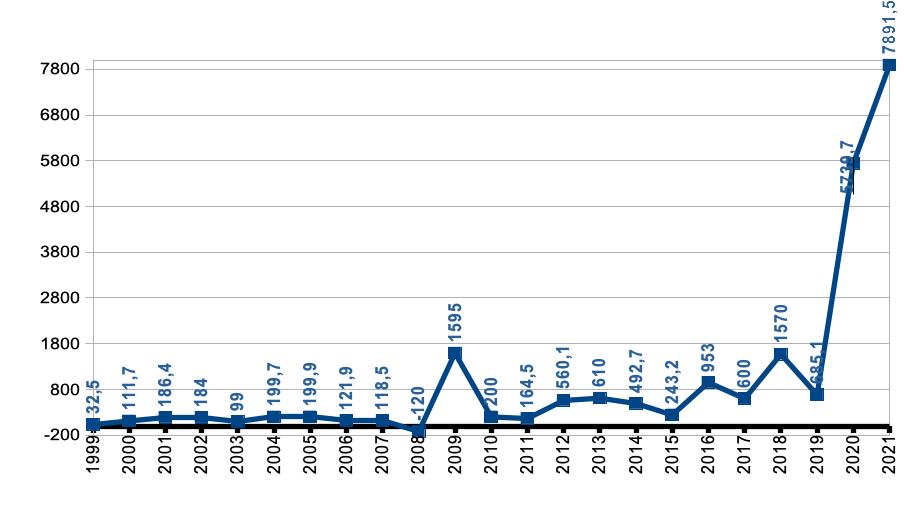

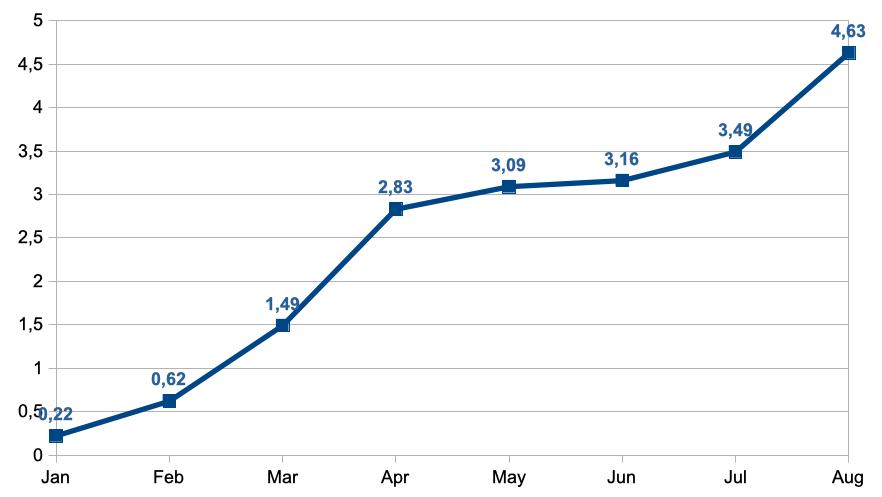

The Ministry of Finance has stumbled. A "pit" has appeared in the government securities market in August 2021. According to the law on the 2021 budget, the Ministry of Finance must contribute 7891.5 million lei from the sale of government securities (GS) in the primary market to finance budget needs.

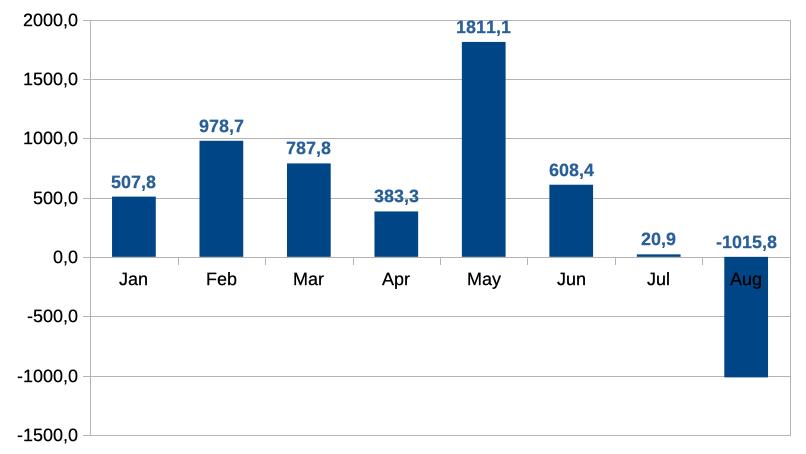

For 7 months of 2021, the Ministry of Finance managed to allocate 5098 million lei for these purposes, but in August it had to get into the “budget’s pocket.” According to the results of 8 months of 2021, the amount of maturing securities redeemed in August did not exceed the amount of placed government securities totaling 1015.8 million lei. In fact, this difference in August was covered at the expense of the expenditure side of the budget. In August, the amount of redeemed maturing government securities exceeded the amount of placed securities.

Financing of budget needs by placing GS in the primary market by months (million lei)

The Ministry of Finance’s situation is complicated by several factors at once. First, it was reported that at a meeting with bankers in early September, Finance Minister, Dumitru Budianschi, announced his intention to increase to 11 billion lei the amount of financing this year through the initial placement of government securities. This is 28.3% more than planned in the current law on the 2021 budget, an indicator that is already a unique record for this market in the entire history of its existence.

It should be noted that the data for 2021 presented in the graph is the current version of the budget. If the new parliament changes it with an increase to 11 billion lei, the growth curve will be even more impressive.

The Moldovan budget has always been partially replenished at the expense of government securities. As a rule, the funds went to finance the deficit. But the governments did it carefully, allocating 100-200 million lei a year.

Several points stand out in the graph. In 2008, for the first time (and the only time) in the history of the Ministry of Finance, it was possible not to increase the government securities in circulation, but, on the contrary, to redeem securities amounting to 120 million lei from the market. But in 2009 (and this was the year of parliamentary elections) there was not enough money in the budget (in the election year there was no external funding) and The Ministry of Finace had to urgently borrow funds in the domestic market, issuing more government securities.

Further, the graph speaks for itself. When the budget needed money, the Ministry of Finance turned to the domestic market, selling government securities. An especially sharp jump took place in 2020 (it is understandable - the pandemic), and 2021 is generally “out of competition”. By the way, 2021 in Moldova is also an election year, and with the beginning of autumn, full-fledged external funding still has not been enabled.

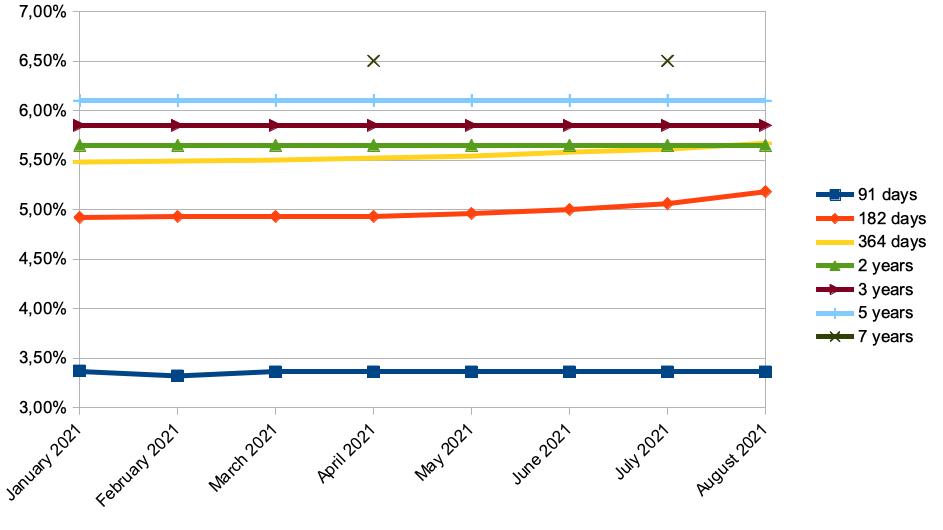

Let's focus on the current period. The main (if not the only) investors in the government securities market are commercial banks. Financing the state budget is a very convenient activity for them: the rate is higher than inflation, higher than the base rate of the National Bank and, although it is slightly lower than lending, there is no headache. Moreover, government securities are equated by the regulations of the National Bank to highly liquid assets.

The rates are quite acceptable for the Ministry of Finance. However, in August, the Ministry of Finance redeemed securities for a billion lei more than it had placed... And the banks were not active in the market that month. One of the reasons lays in the actions of the "chief in charge of money" - the National Bank of Moldova (NBM).

On July 30, 2021, the NBM raised the base rate from 2.65% per annum to 3.65% per annum since there were grounds for this, given the dynamics of inflation. With an increase in the base rate by one percentage point, its growth amounted to 37.7%. The base rate is an indicator for the market that covers many areas.

With the growth of the base rate, banks expect that the Ministry of Finance will also increase the yield on securities. Everyone knows that, when the Ministry of Finance announces an auction, it announces the securities that it wants to sell and their amount. Investors, in turn, submit an application to the Ministry of Finance for the purchase of a certain amount and a certain type of securities, offering their price. If the Ministry of Finance is satisfied with the price, it satisfies the application, if not, the securities remain unsold.

This happened in August as well. It looks like the banks "boycotted" the purchase of government securities, either because the Ministry of Finance did not offer an increase in rates by a third (which is equal to the increase in the base rate), or the banks ran out of free money.

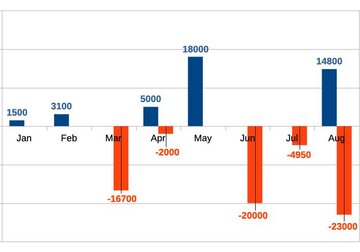

Results of auctions for the sale of GS in August (million MDL)

| Emission | Offers | Alocated | Media Rates | |

| AUG 3 | ||||

| 91-Days | 200,0 | 149,1 | 82,76 | 3,36 |

| 182-Days | 800,0 | 343,9 | 252,54 | 5,14 |

| 364-Days | 800,0 | 352,2 | 248,1 | 5,65 |

| AUG 4 | ||||

| 2-Years | 40,0 | 2,8 | 2,8 | 5,24 |

| AUG 17 | ||||

| 91-Days | 200,0 | 146,2 | 44,5 | 3,36 |

| 182-Days | 800,0 | 349,7 | 258,2 | 5,21 |

| 364-Days | 800,0 | 272,1 | 252,1 | 5,68 |

| AUG 18 | ||||

| 2-Years | 50,0 | 6,8 | 6,8 | 5,73 |

| 3-Years | 50,0 | 2,1 | 2,1 | 5,94 |

| 5-Years | 50,0 | 5,1 | 5,1 | 6,19 |

| TOTAL AUGUST | 3790,0 | 1630,0 | 1155,0 | - |

Maybe the banks really "ran out" of money to purchase government securities? You can ask about this the “chief in charge of money” - the National Bank of Moldova (NBM).

As you know, the primary task of the NBM is to maintain the inflation rate within the given corridor of 5% per annum, plus / minus 1.5 percentage points. That is, in the range from 3.5% to 6.5% per annum. Without a given inflation, there is no economic development. And inflation in Moldova in 2020-2021 "has stuck". This greatly worried the NBM, which since early 2021 has been taking active steps to fulfill its main mission.

For this, the National Bank has several instruments, the most obvious of which are foreign exchange interventions and the base rate (along with the required reserve rates).

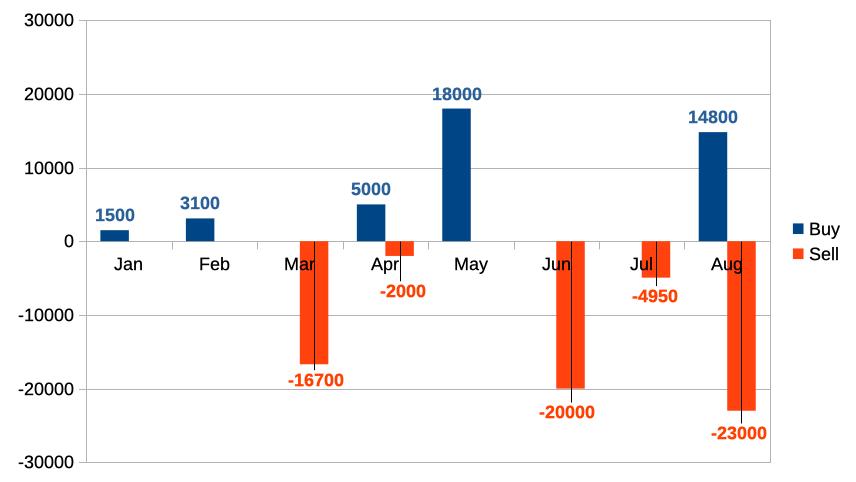

In 2021, the NBM is quite active in the foreign exchange market. (Here it is worth mentioning that all the NBM governors are dreaming, and the IMF would be happy if the regulator refused currency interventions altogether. But times are hard now).

It is known that, the NBM should be careful in the foreign exchange market, maintaining a balance between foreign currency demand and supply, including, in order to prevent strong fluctuations in the exchange rate of the Moldovan leu (MDL). In addition, the regulator understands that if it gets carried away with "currency transactions", other market participants will join the game, and this can lead the situation out of control.

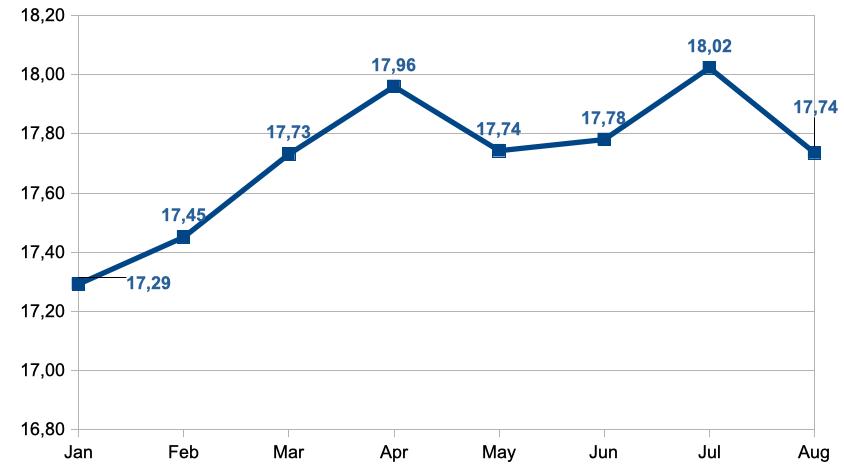

We have already witnessed a similar situation in 2012-2014: while carrying out active foreign exchange interventions, the National Bank missed the moment when other participants joined the game in the market, including those who were buying up currency in the notorious history of the “billion”. This led to a strong devaluation of the MDL: from 11.7 lei per 1 USD in early 2012 to 15.1 lei per 1 USD in late 2014.

One of the lessons that the National Bank learned then was the tightening of administration on its part of all foreign exchange transactions, including interbank transactions. But the main lesson to be learned is that when entering the foreign exchange market, the NBM must understand that other participants can also join the game. And the longer the regulator carries out foreign exchange interventions, the more difficult it will be to prevent the formation of a “snowball”.

In August, the NBM carried out the largest volume of foreign exchange interventions in 2021, actively buying and selling foreign currency. This led to some strengthening of the MDL.

Exchange rate dynamics in January-August 2021 (MDL vs USD)

It is interesting to compare these two graphs. But the results of September will be even more interesting. At the beginning of the month - September 6, 2021 - the NBM again raised the base rate - already up to 4.65% per annum. Inflation has been brought to the target level (almost 5% per annum in late August). And the exchange rate in September is in the corridor of 17.5 - 17.7 lei per 1 USD.

Against this background, it can be assumed that investors in the government securities market will expect from the Ministry of Finance adequate actions to increase the rate of the securities sold. Otherwise, the Ministry of Finance will definitely not reach the almost 8 billion lei level set by the law on the budget, especially the estimated horizon of 11 billion lei declared by Minister Dumitru Budianschi.

It will be no less interesting to watch the National Bank’s actions in the foreign exchange market (the results of September will be announced in the third decade of October). If external financing goes to Moldova, we should expect a weakening of the MDL, so that against the background of the foreign currency sale, the budget to receive more financing in national currency (MDL). We are also waiting for data on annual inflation as of the end of September.

Although, some data for September is already known:

Results of auctions for the sale of GS in September (million lei)

| Emission | Offers | Alocated | Media Rates | |

| SEPT 1 | ||||

| 91-Days | 200,0 | 63,2 | 45,6 | 3,36 |

| 182-Days | 800,0 | 340,8 | 329,8 | 5,25 |

| 364-Days | 800,0 | 224,2 | 214,2 | 5,74 |

| SEPT 2 | ||||

| 2-Years | 20,0 | 6,8 | 6,8 | 5,31 |

| SEPT 14 | ||||

| 91-Days | 200,0 | 162,4 | 27,5 | 3,48 |

| 182-Days | 800,0 | 624,4 | 560,2 | 5,3 |

| 364-Days | 800,0 | 364,2 | 334,9 | 5,81 |

| SEPT 15 | ||||

| 2-Years | 50,0 | 10,5 | 10,5 | 6,09 |

| 3-Years | 50,0 | 2,7 | 2,7 | 6,19 |

| 5-Years | 50,0 | 10,5 | 10,5 | 6,3 |

| TOTAL SEPT | 3770,0 | 1746,5 | 1542,7 | |