On inflation, deflation, rates and Moldovan leu (MDL) exchange rate

Commentary by InfoMarket agency

In the fight against inflation over the past almost two years, the National Bank has used all the tools at its disposal. Perhaps, so boldly that now the question is: are the regulator's brakes reliable? Will it not happen that the inflation rate, having reached the target of 5% per annum, will not be able to stop щn time in the target corridor of +/- 1.5 percentage points, i.e. from 3.5% to 6.5% per annum, and will go into deflation?

Lessons from 2012-2014

We have already witnessed something similar in 2012-2014. The inflation rate in 2011 amounted to 7.6% per annum (which is above the target corridor). But its dynamics by the efforts of the National Bank (NBM) slowed down quite sharply and at the end of 2012 inflation amounted to 4.6% per annum. That is, the decline in inflationary "temperature" to the norm (5%+/1.5 p.p.) has overcome the "golden mean" and was approaching the lower limit. In order to prevent this, the NBM "activated the brakes" - in 2012 this was expressed in the regulator's interventions in the foreign exchange market. The swing of the Moldovan leu (MDL) exchange rate had to stop the sharp decline of the inflation rate and prevent it from falling below the bottom line of the corridor.

During 8 months, until May 2012, the NBM did not make any interventions on the foreign exchange market. However, from May to December, it bought USD 322 million from the foreign exchange market. (It is important: at that time, the country's foreign exchange earnings were formed mainly by exports, and not by international loans and grants, as it happens in recent years). During this period, the National Bank increased the monetary base (indicator M0, money in circulation) by 22%! The increase in the volume of MDL mass on the market put pressure on deflationary processes and in 2012 managed to keep inflation within the corridor, including through the devaluation of the MDL. In 2012, the National Bank replenished its reserves by almost 27.97% (by $549.7 million). In one year, from $1965.3 million at the beginning of the year, to $2515.0 million - at the end. That is, in addition to buying foreign currency on the domestic market, the NBM earned about 10% more on its placement and exchange rate difference.

In 2013, the situation reoccurred. The deflationary processes launched by the regulator earlier continued to influence the market and the NBM continued to buy foreign currency, especially in July-August 2013. During the year - almost $293 million. And everything seemed to be fine. In 2013, inflation amounted to 4.6% per annum, as well as a year earlier.

The regulator has fulfilled its main duty - to maintain the inflation rate in the country within the target. To be fair, it should be noted that the NBM used other available tools, for example, reducing the base rate from 4.5% to 3.5%, but the main message we want to convey is different.

The National Bank’s two years of playing and rocking the foreign exchange market (while devaluing the national currency: the MDL fell in price in two years from 11.5174 lei in early 2012 to 13.057 in late 2013. In 2014, other market participants decided that if the NBM allows itself such active actions on the foreign exchange market, why shouldn’t they as well make money on the exchange rate difference?

In October 2013, in one of its monetary policy decisions, the National Bank stated: "the moderate depreciation of the national currency this year is in line with the NBM's monetary policy and is aimed at directly containing inflation and contributing to reducing deflationary pressures by stimulating domestic demand".

Thus, the bank openly admitted that all its actions, including the purchase of foreign currency and, as a consequence, the depreciation of the MDL, were not conditioned only by market needs, but, on the contrary, were a deliberate policy of the National Bank.

Eventually, the mechanism was launched, and other market participants joined the National Bank. But now the National Bank itself was unable to stop the swing it had personally rocked.

In November 2013, the National Bank stopped buying foreign currency. In November and December, it did not show itself on the foreign exchange market at all, while the MDL continued to devalue.

The situation led to the fact that in February 2014, the National Bank had to urgently fill the market with foreign currency to keep the MDL exchange rate from further decline - it sold 73 million U.S. dollars.

And concomitantly, at that time, NBM Governor Dorin Dragutanu threatened commercial banks in various media outlets, saying that he would openly name those who engaged in speculation.

As a consequence - there were victims, there were tightening of regulations in order to keep the foreign exchange market managed by the National Bank of Moldova. What is allowed to Caesar...

We are used to it - the currency market in Moldova can be called free only in very limited periods of absence of shocks, including from outside.

The market calmed down. But not immediately. The NBM kept inflation in check, but not the MDL exchange rate: by September 2014, the MDL exchange rate was already 14 lei per $1. This devaluation of the MDL was due to market mechanisms and NBM's interventions.

... Subsequently, since the fall of 2014, the situation on the foreign exchange market did get out of the regulator's control. But this is the infamous story of "stealing the billion". And the change in the dollar exchange rate and the devaluation of the MDL played not the last role in this story. However, many people still remember the "rally" of that period. Only a few understand the reasons for what happened. But this is another story.

Parallels: 2022-2023

Why such a detailed description of the events of ten years ago? The reason is that the current situation has many parallels with that period.

Foreign exchange reserves are at a record high level - over 5 billion, which is a new historical record.

Certain actions of the NBM and the country's leadership influenced the situation then, and they influence it now. But the question remains open: do external or internal factors have a significant impact on the situation in Moldova?

Let's consider it in sequence. In 2020, the world faced a pandemic and deflationary processes related to the effect of pent-up demand. As economists warned at that time, the world had to prepare for inflation, and even hyperinflation.

Moldova felt the beginning of inflation after the pandemic in the fall of 2021, which was followed by the outbreak of war in Ukraine in February 2022 and subsequently the energy crisis.

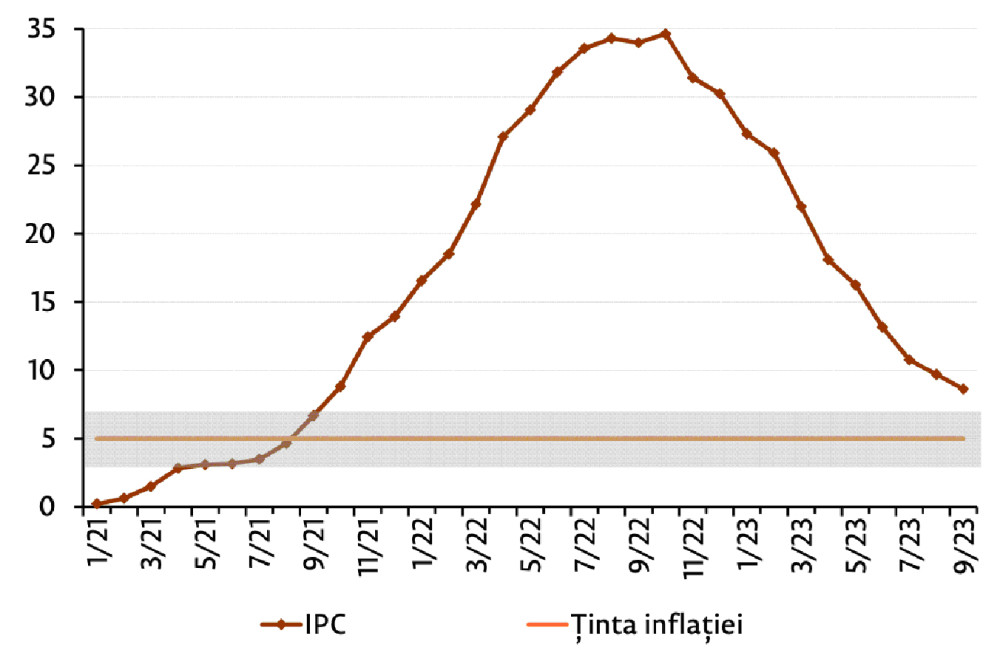

In 2019 (before the pandemic), inflation in Moldova was 7.5% per annum. In pandemic 2020 - 0.39% per annum, in 2021 - 13.94%. Everything - as economists forecasted. But then it started: inflation in Moldova during this period reached its highest peak in October 2022, amounting to 34.6% per annum.

That is, for 22 consecutive months it was continuously growing. But, having overcome the peak, it returned to the set corridor during the next 12 months. Inflation in Moldova was outside the corridor in the period October 2021 - October 2023.

Annual rate of the Сonsumer Price Index (in %)

Сonsumer Price Index

Inflation Target

Source: NBS, NBM calculations

The new NBM forecasts, announced by Governor Octavian Armasu in mid-November 2023, suggest that in 2023 inflation in Moldova will be 13.6%, and in 2024 - 4.5% per year.

Exactly one year ago, in November 2022, the forecast announced by the NBM suggested that in 2022, inflation would amount to 28.8% and 16% in 2023. In fact, in 2022, it amounted to 30.24% - slightly higher than the NBM forecast, and the forecast for 2023 is now 13.6%. In July this year, the National Bank's forecast was 13.3% for 2023 and 4.8% for 2024.

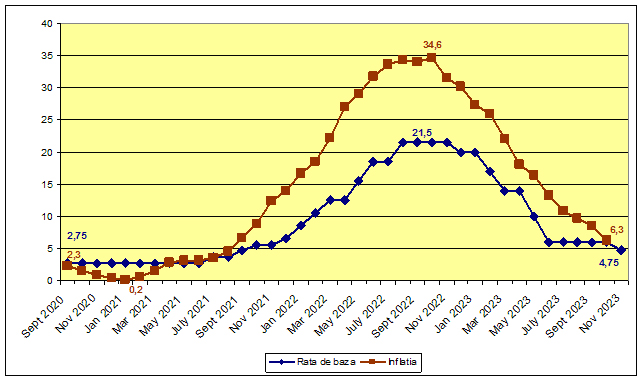

Forecasting is often an ungrateful business, especially if it is influenced by factors beyond your control. Although the NBM has its own instruments. One of them is the base rate.

The higher it is - the more expensive money is, the more expensive money is, the more attractive are deposits and unattractive are loans, which means that consumption decreases, there are more goods, and they become more expensive slower due to the decrease in demand.

Interestingly, when inflation was rising, the NBM did not seem to be able to keep up with the inflation rate. The rate was always below the inflation rate, which should have been a deterrent indicator for the market: this increase in inflation is not for long. The rate was being raised by big strides. But the market could not raise deposit and lending rates as sharply, otherwise banks would be left without customers and the economy would collapse.

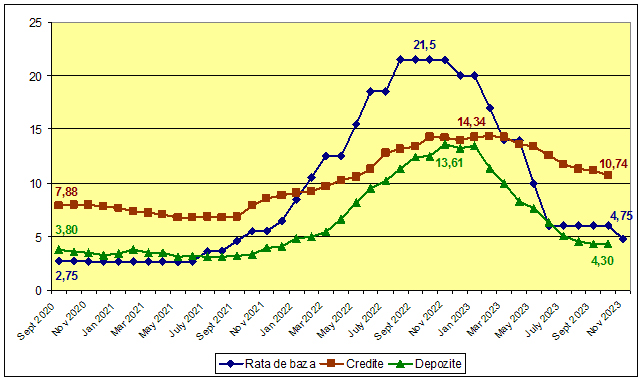

Dynamics of growth of the base rate and average rates on loans and deposits

Important: Loans and deposits are represented by average rates on new loans/deposits in the banking system in national currency for legal entities and individuals.

As we see, since June 2021 deposit rates have not kept pace with the base rate, and from January 2022 to April 2023 - the credit rate has already "sagged" under the base rate. But if deposit rates are practically repeating the dynamics of the base rate, loans behave differently. In order not to "kill" their borrowers with the same sharp increase in lending rates as the base rate, commercial banks allowed themselves a gradual increase. But, when the NBM rate went down sharply from May 2023, the lending rates did not show the same vigor, and are falling much slower.

How does all this affect inflation? High lending rates reduce demand for loans, which means no new money is flowing into the economy. And high deposit rates sterilize savings, which are similarly withdrawn from consumption. But now, with a sharp decline in the base rate, deposits become less attractive.

The National Bank was ahead of the curve with its actions and even, most likely, accelerated inflation to the level when it can control it. When the peak was passed, the regulator took measures to bring inflation back to the corridor as soon as possible. But sharp measures both in one direction and another direction can be compared to a sharp start of a car on the highway followed by a sharp braking. It is not always possible to set the braking to the set line.

The NBM recognizes the risks of deflation (which is also very bad for the development of the economy) and has started a stimulative monetary policy, for example, it reduced the base rate from 6% to 4.5% from November 7, 2023, the norm of required reserves in MDL from 34% to 33%, the norm of required reserves in currency from 45% to 43%. Let us remind you that the required reserves ratio is the funds attracted by commercial banks (in the respective currency), which they have to keep at the NBM (at a "symbolic" interest), which prevents these attracted funds from being injected into the economy, i.e. the instrument sterilizes the money supply. Weakening the requirements for these indicators releases certain funds to the market, which has the effect of increasing demand and inhibiting deflationary processes.

Octavian Armasu states that the NBM has embarked on a stimulative monetary policy, using the instruments at its disposal, supported by the expansionary fiscal policy of the state (this is when the government spending on goods and services increases, thus turning on the economy, and also decreases the net tax revenues, which releases the taxpayers' funds to inject them into the economy).

In general, the NBM says it is constantly monitoring various scenarios and is ready to apply monetary policy measures to combat the risk of deflation.

For the next two years, the regulator believes that inflation, although it will be within the corridor, will be closer to its lower value. But it does not rule out that under certain circumstances, which most likely do not depend on internal factors, inflation by the third quarter of 2025 may fluctuate from 3.9% to 11.7% per annum.

But pay attention to the graph presented by the National Bank, in which it forecasts (read - regulates) the inflation rate in such a way that already in Q2 2024 it will be at the lowest position of the given corridor, i.e. 3.5% per annum. And up to the first quarter of 2025 it will not rise to the average value of 5% per annum.

Consumer Price Index with the uncertainty interval (in % to the previous year)

Variation Interval

Uncertainty Interval

Source: NBS, NBM calculations

In other words, the NBM shows that inflation will be under control, but in the lower zone of the corridor. The fact that in the first quarter of 2024 it forecasts an annual rate of 5.5%, and in the second quarter - 3.5% at once, indicates that the acceleration was taken abruptly and the NBM may be preparing to slow down, if the situation is not affected by internal or external factors. So, it is possible that the base rate will be reduced again in December. The question is: by how much?

For completeness of the analysis, let us present one more graph, without comments.

Dynamics of annual inflation and the NBM base rate

As in the case of the situation in 2012-2014, there may be those willing to participate in this "rally" in the markets, where, based on this forecast, it is possible to make money, for example, in the currency market. And the situation may have a strong impact on the national currency rate.

What the market will say

While paying attention to the first graph: the sharp increase in inflation, which was mainly due to external factors, and the sharp decrease in inflation, mainly due to internal measures of the NBM, we can assume that in the near future the inflation rate, the deposit and credit rates, the recovery of demand and even the growth of the economy, will be influenced by the internal market of Moldova.

It means to what extent the economy will be ready to consume and produce again, whether consumers will have money to consume local and imported goods. This matter raises a question.

Thus, Octavian Armashu, while answering the hackneyed question about the MDL exchange rate, noted a sharp decline in the demand for currency - importers have abruptly stopped importing goods, which means that the demand for currency has fallen sharply. The reasons are known and they all stretch back to events starting from 2020.

Yes, in July-September, lending grew in Moldova, but the dynamics is still unclear. Thus, in June 2023, year-on-year credit growth amounted to 10%, in July - 85%, in August - 133%, in September - 95.1%. It would seem that we are reaching the indicators of last year, but last year itself cannot be called indicative.

And if we don't intervene, Moldova's economy may get stuck in a chain: decrease in crediting - decrease in production - decrease in consumption - decrease in budget revenues - increase in budget deficit - increase in unemployment....

A lot depends on NBM's actions, and it is important for it not to lose control over the situation. So far, it has not come to that - the regulator is taking logical, albeit sharp, actions.

The economy is jammed and almost dying, the National Bank is now trying to rock it. It realizes that it may face deflationary processes, which, dare we say, have already begun.

It is interesting that politics also influences the NBM actions, no matter how it denies it. The changes regarding the indexation of pensions made a lot of noise in the society. Let us remind you that the legislation provided for the annual indexation of pensions in accordance with the annual inflation rate. In 2022, the indexation amounted to 13.94% - the same annual inflation rate. In 2023, the annual inflation rate was 30.24%, but there is no such money in the budget and it was decided that the indexation will be 15%, which caused resentment of pensioners. So, what inflation will be at the end of 2023 very much depends on the political, social and budgetary impact.

This is one example of the undercurrents that are affected by the inflation rate. In fact, there are many more. Now it is important to understand whether inflation will turn into deflation in the coming months and quarters and, if so, by how much? It should be reminded that one of the tools that the NBM possesses to bring and keep inflation within a given corridor (this is the main task of the regulator) is the foreign exchange market: the volume of foreign exchange reserves and opportunities for interventions, the exchange rate of the national currency, finally.

And, since we have started talking about the national currency, let us congratulate the National Bank and all of us on the 30th anniversary of the Moldovan leu (MDL), which was born on November 29, 1993. // 23.11.2023 - InfoMarket.